Mifos Android Client Version 3.0 Now Available on Google Play

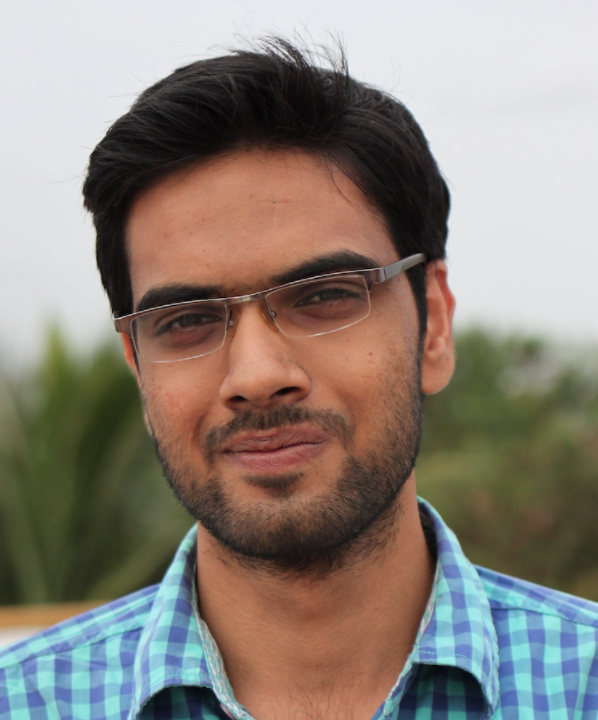

We’re happy to announce that our latest version of the Mifos X Android Field Officer App is now available on the Google Play store. This release is a culmination of the efforts of many volunteers and interns over the past year and a half but couldn’t have been possible without the leadership and dedication of Rajan Maurya. He poured his heart into refactoring the codebase and implementing offline functionality during Google Summer of Code and has continued that dedication since then. Through all hours of the night, he’s been continuing to add new features and fix bugs to get this release out to the community.

We’re happy to announce that our latest version of the Mifos X Android Field Officer App is now available on the Google Play store. This release is a culmination of the efforts of many volunteers and interns over the past year and a half but couldn’t have been possible without the leadership and dedication of Rajan Maurya. He poured his heart into refactoring the codebase and implementing offline functionality during Google Summer of Code and has continued that dedication since then. Through all hours of the night, he’s been continuing to add new features and fix bugs to get this release out to the community.

Work has not stopped as we have a ton of ongoing functionality to add that we’re targeting as a 2017 GSOC Project for Android Field Officer App Version 4.0

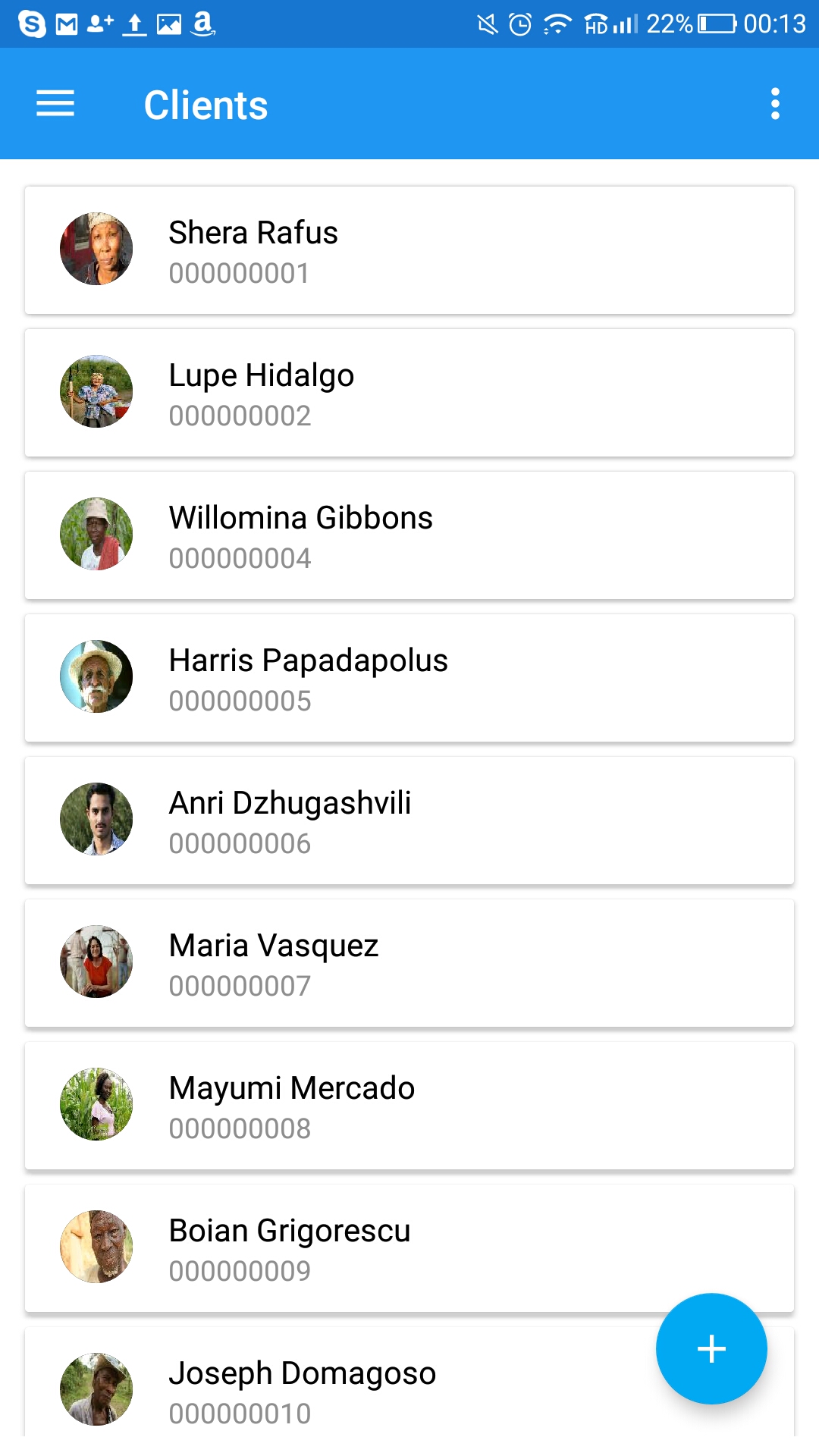

Read on for a deep dive on each of the new features but here’s a small snapshot of all the new functionality in Version 3.0:

Technical Enhancements

- Implementation of Material Design (Thanks to Olya Fomenko!)

- Refactoring into MVP architecture for improved performance

Functional Enhancements

- Create center new groups & centers

- Improved navigation & advanced search

- Open, approve, and disburse new loan & savings accounts

- Attach documents to loan & savings accounts.

- Offline Data Collection & Synchronization

- Synchronize clients and groups for offline data entry

- Enter repayments, deposits, and withdrawals while offline

- Create new clients, loans & savings accounts while offline

- GIS Features

- Pinpoint client GPS location

- Track route of field officer

Thanks to the Contributors

Thank you to all of the following contributors who made this release possible: Rajan Maurya, Ishan Khanna, Olya Fomenko, Mayank Jindal, Tarun Mudgal, Ahmed Fathy, Nelly Kiboi, Illia Andrieiev, Padmal, Vishwajeet Srivastava, Nasim Banu, Chhavi Gupta, İhsan Işık, Vatsal Bajpai, Alex Chege, Justin Du, Prempal Singh, Rowland Oti, Siddhant Kumar Patel, Suhaib Khan, Chashmeet Singh, Ashutosh Dadhich, Aashir Shukla, R Harikrishnan, and Vishwesh Jainkuniya.

We’re recognizing Mohit Kumar Bajoria of Jammu, India. Mohit has been a member of our community since he joined us a GSOC intern in March of 2016 and worked on adding browser-based offline access to the Community App underneath the mentorship of Gaurav. Since then he’s continued to excel and be an active part of the community first by acting as a GCI mentor and now by taking the initiative to fix the remaining bugs in the re-skin so it can be shipped to the community. These past couple of weeks, Mohit has really demonstrated his leadership by stepping up to become maintainer of the re-skin branch all on his own doing – he’s been mentoring other contributors, squashing lots of bugs, and reviewing and merging incoming pull requests. This call to leadership has been opportune as we seek empowered individuals from the community to stabilize and maintain Generation 2 as we transition to Generation 3.

We’re recognizing Mohit Kumar Bajoria of Jammu, India. Mohit has been a member of our community since he joined us a GSOC intern in March of 2016 and worked on adding browser-based offline access to the Community App underneath the mentorship of Gaurav. Since then he’s continued to excel and be an active part of the community first by acting as a GCI mentor and now by taking the initiative to fix the remaining bugs in the re-skin so it can be shipped to the community. These past couple of weeks, Mohit has really demonstrated his leadership by stepping up to become maintainer of the re-skin branch all on his own doing – he’s been mentoring other contributors, squashing lots of bugs, and reviewing and merging incoming pull requests. This call to leadership has been opportune as we seek empowered individuals from the community to stabilize and maintain Generation 2 as we transition to Generation 3.