Three Countries. Three Conferences. One Common Theme.

Now that the team has safely returned from travel to our three events – our presence at each one has confirmed that our next generation Mifos architecture is the right solution that is needed to guide the world towards Financial Inclusion 2.0. Each stakeholder is ready for this new era – partners building solutions, financial service providers needing greater efficiency to reach their clients, regulators seeking stability and control, and investors seeking transparency and impact.

At TechDays in Amsterdam, the need for the 3rd Generation of Mifos was confirmed by partners new and old. The growth of our partners like Musoni Services and Conflux Technologies showed that they’re reaching a critical point of scale where a new lightweight, cloud-native, and highly scalable architecture is needed. The direct presence of brand new partners confirmed that we are the innovation that powers innovators and that each day new partners are coming our way to build apps that are mobile-first and cloud-enabled.

At the 18th Microcredit Summit in Abu Dhabi, we confirmed the opportunity to set a standard for innovation and be the driving force behind Financial Inclusion 2.0. The entire industry as a whole is aligning for this to be a reality – financial inclusion providers are ready to go digital and recognize its benefits, national regulators are fostering and advancing an enabling ecosystem, and the technology has evolved with unparalleled computing power available at low cost.

At the Global Microfinance Forum in Berlin, the focus was on investors but they all echoed the pain we’re addressing: costs are too high, access is too hard, innovation is too slow and change is needed. When they gave case studies on examples of successful innovation, they highlighted Musoni Services, one of our gold platform partners that is powered by Mifos X. Meeting these investors and apex organizations was great validation that we are the innovation that powers the innovators.

Craig and Markus will be providing more detailed recaps of our TechDays and the Global Microfinance Forum so I’ll give a more detailed recap on the Microcredit Summit in Abu Dhabi.

18th Microcredit Summit Recap

The Microcredit Summit is the foremost financial inclusion gathering of the year. We were honored to participate as a sponsor, a commitment maker, and a speaker. It was the first time we had a direct presence at the Microcredit Summit in nearly a decade since the Global Microcredit Summit in Halifax when Mifos made its debut.

Pioneering Journey through 3 Generations of Mifos Technology

As we touched on above, everyone we spoke to was captivated by the evolution of Mifos with Financial Inclusion 2.0 as the destination. From our booth, we walked attendees through the three generations of Mifos technology, and the pioneering steps we’ve taken from being the world’s first open source MIS to the world’s first open-source API-driven platform for financial inclusion, and with our third generation, the world’s first open source application framework for digital financial inclusion. We got the chance to see current Mifos community members like Byron from SEF, Mark from Phakamani Foundation, and Essma from enda. We re-connected with individuals from PRONAFIM, Grameen-Jameel, Freedom from Hunger, WSBI, Fundacion Capital, PCI, and FINCA. We were also able to catch up with our peer technology providers like Oradian, Temenos, Red Cloud, and Software Group. We even met some great potential strategic advisors like Jorge from the Central Bank of Ecuador and Pramod Varma, the Chief Architect of India’s Aadhaar project.

Digital Revolution & Financial Inclusion

Digital Revolution & Financial Inclusion

Craig played a key role on this highly intriguing panel. It was one of the most informative and interactive panels at the summit. Moderator, Sacha Polverini, Senior Program Officer for Global Policy and Regulation, Financial Services for the Poor, from the Gates Foundation did a wonderful job orchestrating a discussion which allowed each panelists to tell their own but facilitated a natural and engaging dialogue amongst the panelists and audience. This was a difficult feat given the diversity of the panelists which included: jorge Cayo, a Specialist from the Central Bank of Ecuador who highlighted the interoperable payments system they’ve been building, Shahadat Khan from Surecash sharing the perspective providing mobile payment services to more than one million customers in Bangladesh, Innocent from FSDT Tanzania who had an acute understanding of the mobile money on the ground from the perspective of the agent and end user, and Marita Mitschein from SAP on the DFS projects they have led. Craig’s perspective helped to unite everyone with open source as the powerful catalyst for the creation and collaboration of standards which allow innovation to explode.

highlighted the interoperable payments system they’ve been building, Shahadat Khan from Surecash sharing the perspective providing mobile payment services to more than one million customers in Bangladesh, Innocent from FSDT Tanzania who had an acute understanding of the mobile money on the ground from the perspective of the agent and end user, and Marita Mitschein from SAP on the DFS projects they have led. Craig’s perspective helped to unite everyone with open source as the powerful catalyst for the creation and collaboration of standards which allow innovation to explode.

Mifos, as “the open API standards for banking as a service to deliver the mobile rails for digital financial services” couldn’t have been a better fit as the fuel for the digital revolution for financial inclusion.

Launch of DreamSave

We had the pleasure of sharing our booth with Wes Wasson and Henrik Esbensen fr

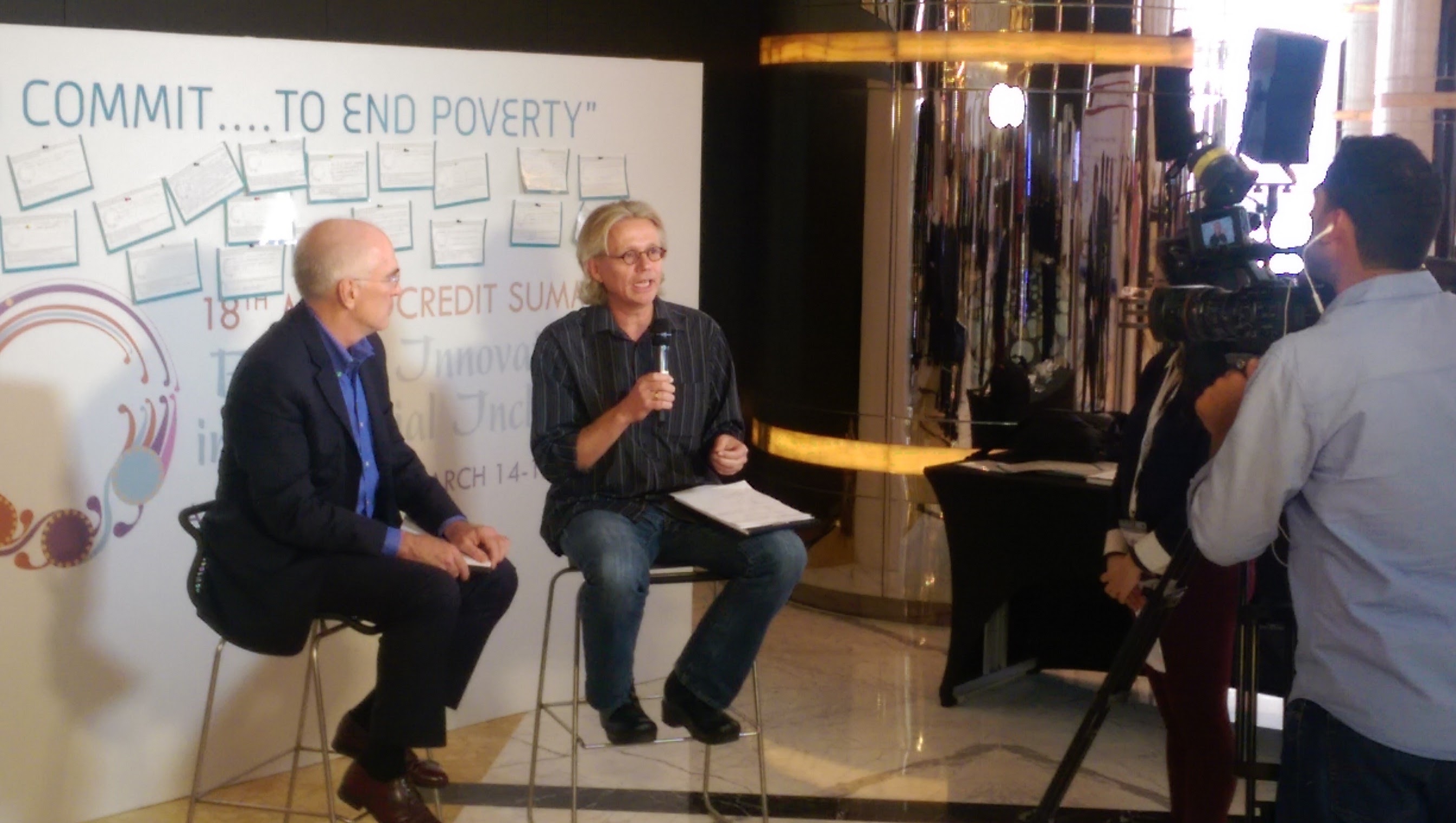

We had the pleasure of sharing our booth with Wes Wasson and Henrik Esbensen fr om DreamStart Labs as they used the Microcredit Summit to formally launch DreamSave and our joint commitment for the 100M campaign. DreamSave was the Belle of the Ball as it garnered a ton of attention as Savings Groups and savings-led financial inclusion were a key focus area as one of the themes the Microfinance Leadership Council is exploring. The team even got to meet directly with Mohammad Yunus. Apart from garnering new interest, the team connected with potential pilot partners and are close to securing a pilot user for DreamSave. Henrik and Craig also did an interview for the Commitment Cafe – you can watch down below.

om DreamStart Labs as they used the Microcredit Summit to formally launch DreamSave and our joint commitment for the 100M campaign. DreamSave was the Belle of the Ball as it garnered a ton of attention as Savings Groups and savings-led financial inclusion were a key focus area as one of the themes the Microfinance Leadership Council is exploring. The team even got to meet directly with Mohammad Yunus. Apart from garnering new interest, the team connected with potential pilot partners and are close to securing a pilot user for DreamSave. Henrik and Craig also did an interview for the Commitment Cafe – you can watch down below.

Muhammad Yunus – the Father of Microcredit

No Microcredit Summit could be complete without meeting Muhammad Yunus. My previous post already captured how powerful and moving his message was so now I’ll just leave you with some photos: