Mifos and Mojaloop – an End to End Open Source Architecture for Digital Financial Services

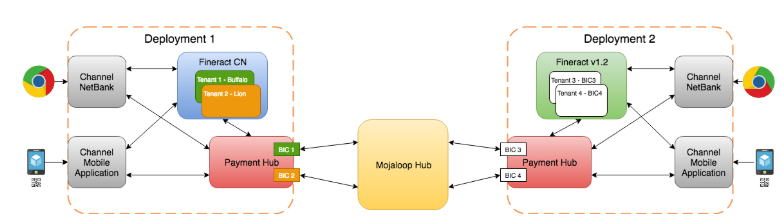

I’m pleased to announce the ongoing collaboration between the Mifos Initiative and the Mojaloop community being funded by a strategic grant from DIAL (Digital Impact Alliance), and their Open Source Center. With the funding from DIAL, we’re embarking on the first step in our vision to create an end to end open source architecture for digital financial services, integrating Mifos and Mojaloop. Mojaloop provides the digital payment rails and Mifos provides the account management engine fueling innovation on top of them. Working with the team at DPC Consulting in Hungary, we have created a Mifos lab which provides a live environment for digital payment transactions to flow through a Mojaloop switch, initiated from accounts held at Digital Financial Service Providers (DFSPs) running Fineract and Fineract CN as their account management system. We had the honor and pleasure of joining the Mojaloop community and demoing this at the recent community convening in Arusha, Tanzania.

In Tanzania we could see the strong progress being made around the codebase and the growing force of the Mojaloop community. Post the convening, the tremendous momentum continued with a number of announcements centered around Mojaloop adoption across all segments of the financial services sector. The Central Bank of the Republic of Tanzania announced the development of TIPS, the Tanzania Instant Payment System, of which they’ve chosen to adopt Mojaloop as the basis for their same-as-cash electronic payment system. WOCCU announced its digital financial inclusion strategy to reach 50 million-plus people across Asia centered around a project to design interoperable, open-loop, low-cost, real-time payment platforms for its global network of credit unions across Asia, exploring the use of the Mojaloop open-source platform. Great progress is being made with the launch of Mowali, the mobile wallet interoperability initiative powered by Mojaloop, and led by Orange and MTN to enable interoperable payments across all of Africa. The DFS Lab Mojaloop Hackathon in Dar Es Salaam, Tanzania, in mid-April is fast-approaching and will give fintech companies an opportunity to develop and test innovative use cases on Mojaloop.

The Mifos Initiative looks forward to being an enabling factor in not only extending the functionality of Mojaloop and evangelizing the platform but most importantly enabling and accelerating adoption by providing a robust lab environment and a Mojaloop-ready open source toolkit of account management systems, mobile wallets and a payment hub to facilitate the smooth integration with the Mojaloop APIs. Our vision is to provide the account and wallet management capabilities for an institution that wants to connect to Mojaloop whether they’re a SACCO or MFI, a fintech company, a mobile wallet provider, or even a bank.

Thank you to DIAL for enabling this collaboration, the DPC team for their stellar work, the Gates Foundation for enabling our participation at the convening and the Mojaloop community and ModusBox team for all their support with the integration.