Mifos and Mojaloop – an End to End Open Source Architecture for Digital Financial Services

I’m pleased to announce the ongoing collaboration between the Mifos Initiative and the Mojaloop community being funded by a strategic grant from DIAL (Digital Impact Alliance), and their Open Source Center. With the funding from DIAL, we’re embarking on the first step in our vision to create an end to end open source architecture for digital financial services, integrating Mifos and Mojaloop. Mojaloop provides the digital payment rails and Mifos provides the account management engine fueling innovation on top of them. Working with the team at DPC Consulting in Hungary, we have created a Mifos lab which provides a live environment for digital payment transactions to flow through a Mojaloop switch, initiated from accounts held at Digital Financial Service Providers (DFSPs) running Fineract and Fineract CN as their account management system. We had the honor and pleasure of joining the Mojaloop community and demoing this at the recent community convening in Arusha, Tanzania.

In Tanzania we could see the strong progress being made around the codebase and the growing force of the Mojaloop community. Post the convening, the tremendous momentum continued with a number of announcements centered around Mojaloop adoption across all segments of the financial services sector. The Central Bank of the Republic of Tanzania announced the development of TIPS, the Tanzania Instant Payment System, of which they’ve chosen to adopt Mojaloop as the basis for their same-as-cash electronic payment system. WOCCU announced its digital financial inclusion strategy to reach 50 million-plus people across Asia centered around a project to design interoperable, open-loop, low-cost, real-time payment platforms for its global network of credit unions across Asia, exploring the use of the Mojaloop open-source platform. Great progress is being made with the launch of Mowali, the mobile wallet interoperability initiative powered by Mojaloop, and led by Orange and MTN to enable interoperable payments across all of Africa. The DFS Lab Mojaloop Hackathon in Dar Es Salaam, Tanzania, in mid-April is fast-approaching and will give fintech companies an opportunity to develop and test innovative use cases on Mojaloop.

The Mifos Initiative looks forward to being an enabling factor in not only extending the functionality of Mojaloop and evangelizing the platform but most importantly enabling and accelerating adoption by providing a robust lab environment and a Mojaloop-ready open source toolkit of account management systems, mobile wallets and a payment hub to facilitate the smooth integration with the Mojaloop APIs. Our vision is to provide the account and wallet management capabilities for an institution that wants to connect to Mojaloop whether they’re a SACCO or MFI, a fintech company, a mobile wallet provider, or even a bank.

Thank you to DIAL for enabling this collaboration, the DPC team for their stellar work, the Gates Foundation for enabling our participation at the convening and the Mojaloop community and ModusBox team for all their support with the integration.

What is Mojaloop?

Dan Kleinbaum and our friends at the DFS Lab provide a nice primer on Mojaloop. To quote Dan,

“In its simplest form, Mojaloop is a payment switch built in open source code. The aim of Mojaloop, an open source project being spearheaded by the Bill and Melinda Gates Foundation, is to create interoperable, low-cost payment systems that allow everyone, especially the poor, to access financial services. Mojaloop aims to accomplish this by using open source software and implementing a clever payment system design that was purpose built for emerging market environments and low value transactions. The principles behind Mojaloop are articulated in the L1P (Level One Project). Mojaloop is the open source software project that implements the L1P principles and system design.”

Why Mifos and Mojaloop?

Mifos and Mojaloop are two highly complementary open source systems that make a perfect fit.

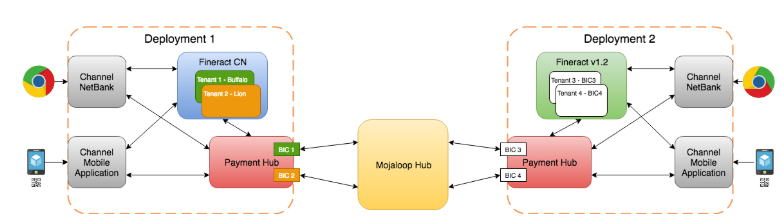

Mifos/Fineract is a full stack core banking and account management platform that serves as the DFSP system needed to connect into a payment scheme that’s powered by Mojaloop. Our Mifos Lab will use Mojaloop as the “switch” between multiple Fineract/Mifos instances in various configurations such as a digital retail bank, an MFI, a SACCO or cooperative, or a mobile wallet provider.

Think of Mifos/Fineract as the DNA of financial services that can be put together in many expressions coupled with Mojaloop as the connective payment tissue enabling interoperability of payments. Any financial service or even any transaction-based product linked to an account or wallet can be designed, created, and scaled effectively and efficiently.

What is the Vision for the Mifos Lab?

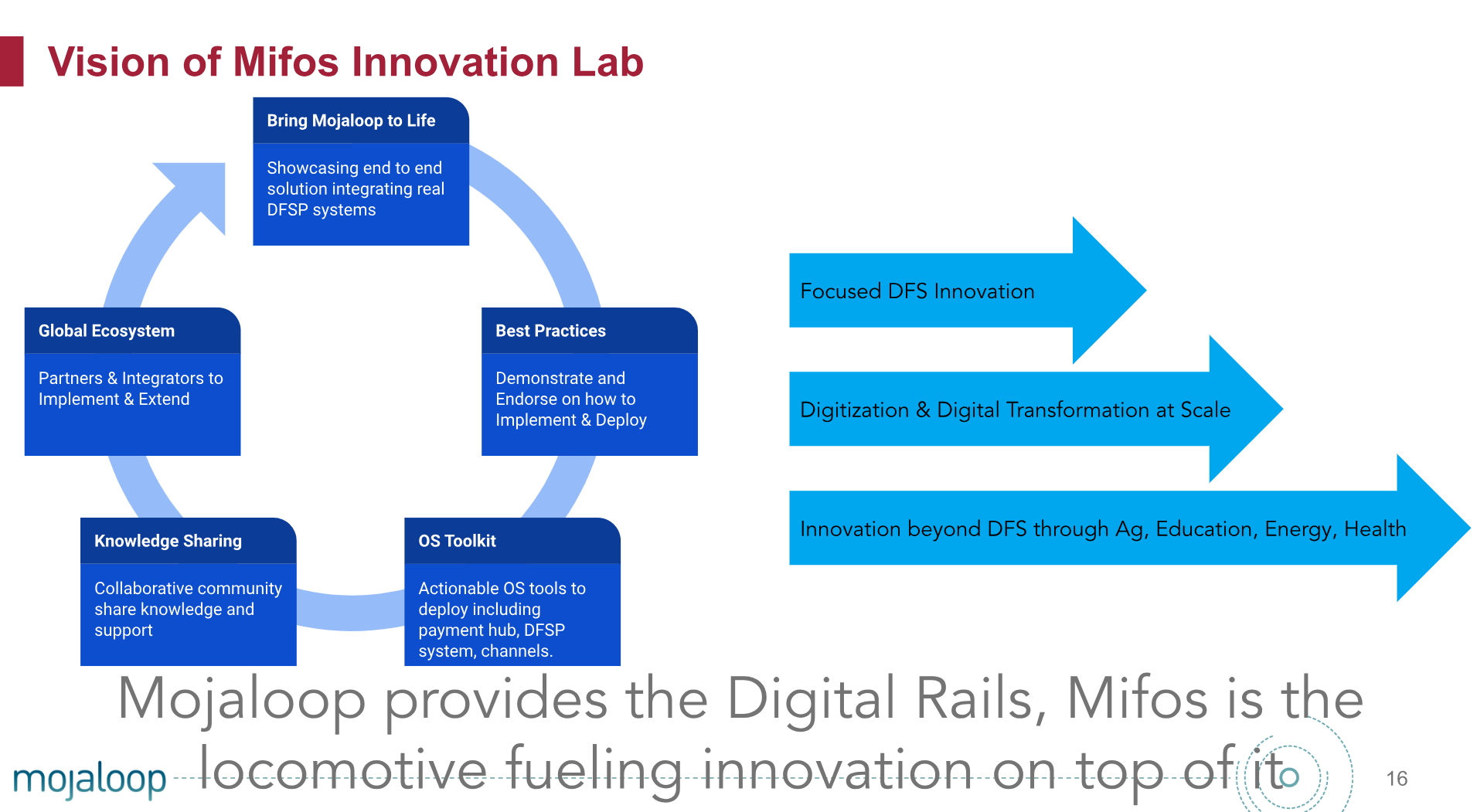

Our Mifos Lab goes well beyond simply the simulation of an end to end environment demonstrating transactions flowing via Mojaloop between different DFSP systems:

- It showcases in a tangible way how the Mojaloop APIs work via rich mobile and web interfaces

- It champions best practices for implementing, deploying and developing open source payment and core banking solutions.

- It provides an actionable open source toolkits of production-ready DFS solutions that can be implemented or extended.

- It harnesses a collaborative community to share knowledge and ideas

- It’s backed by a global ecosystem of system integrators and fintechs that is ready to deploy and extend Mojaloop

Mifos and the Fineract core banking infrastructure has a key role to play in the emergence of payment systems guided by the level one principles. We can provide cost-effective account and mobile wallet management and with core banking built-in we can enable the quick rollout of adjacencies – loan and savings products on top of these digital payment systems.

Key to our support from DIAL is our shared vision for the potential of Mifos and Mojaloop to become the payments backbone for the entire development sector. Innovation doesn’t stop at traditional financial inclusion or even digital financial services as whole. Any service delivered via an account or wallet or any payment/transaction that could be digitized will benefit from this integration – agricultural, clean energy (PAYG), healthcare, and education sector and more.

Here’s the presentation we gave in Tanzania at the convening:

Progress to Date

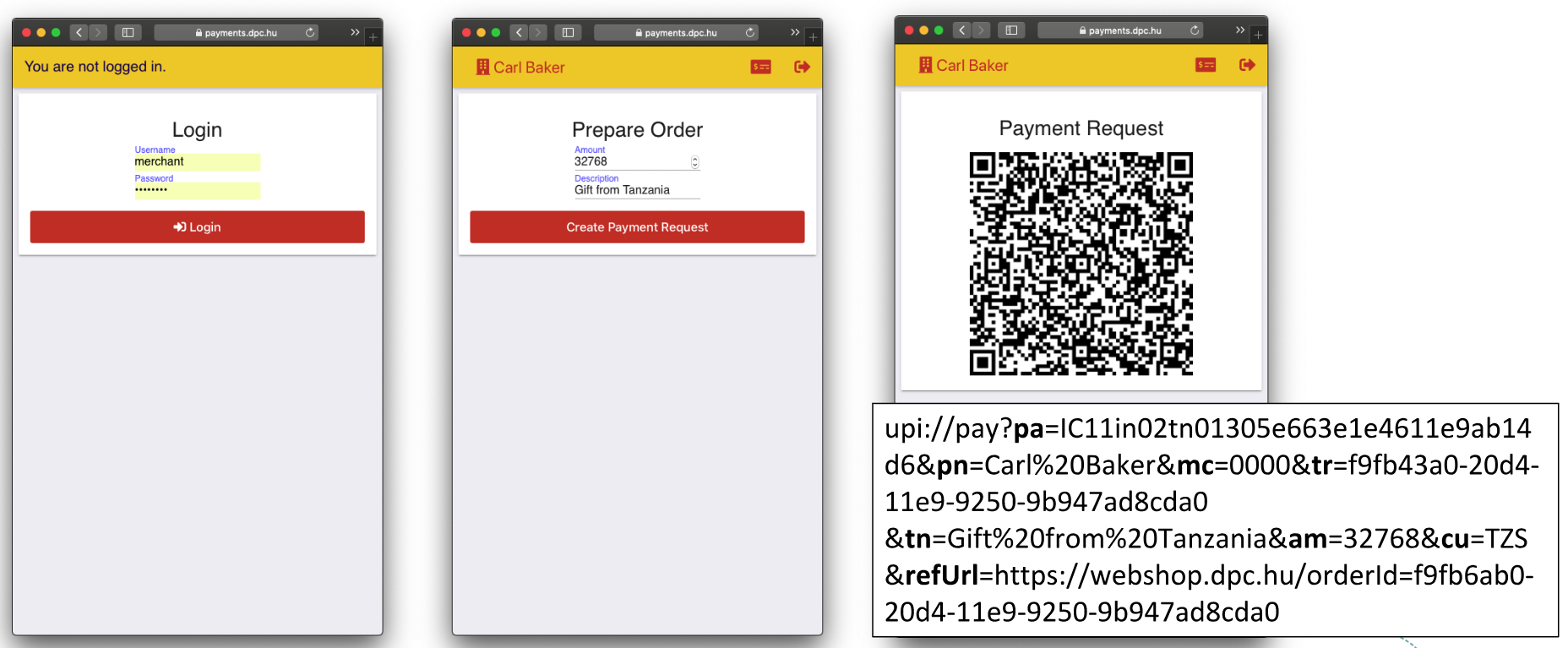

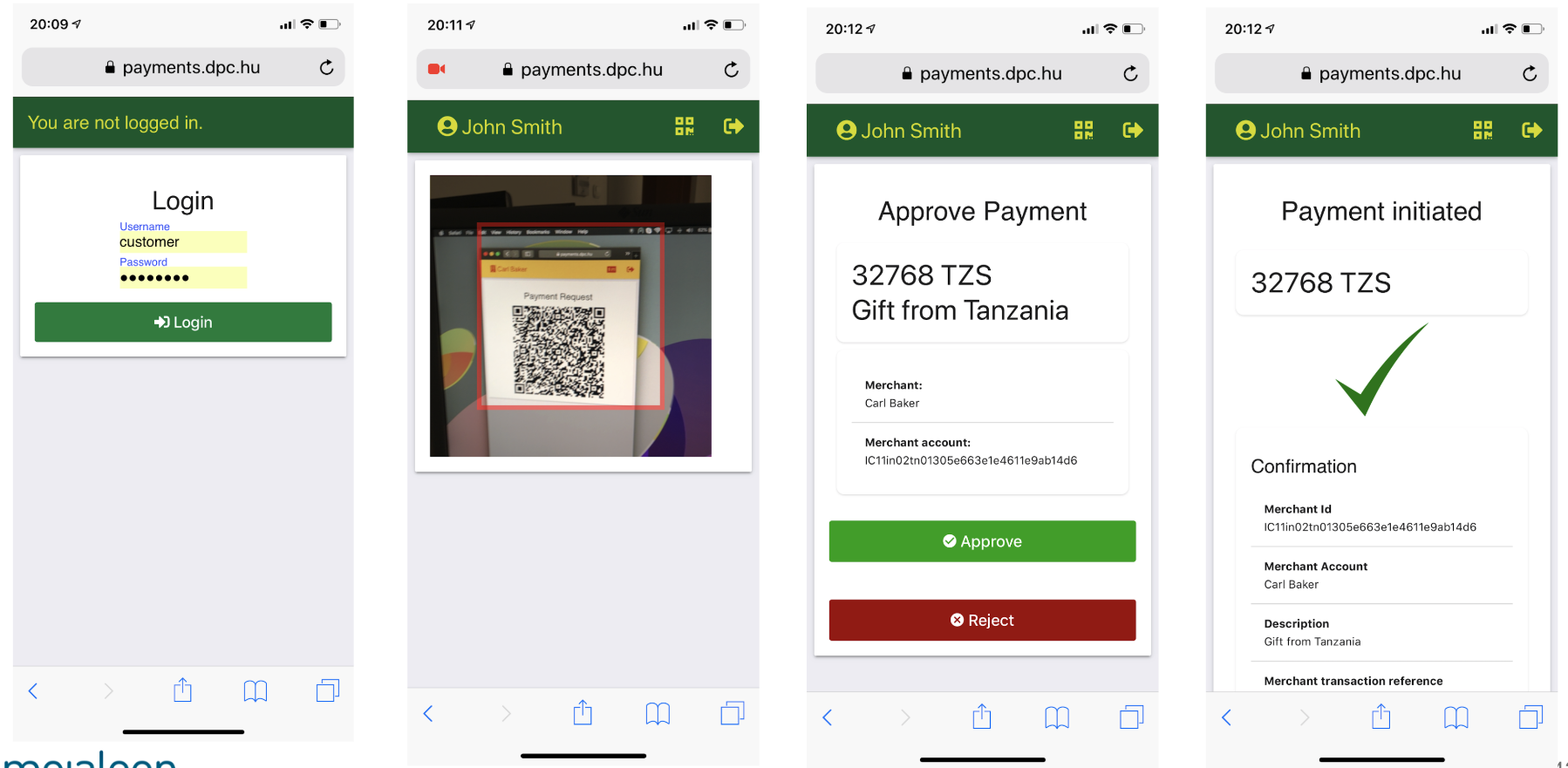

In Tanzania, we did a live demo of the proximity-based merchant payment use case by allowing a merchant with an account in Fineract CN to generate a dynamic QR Code with the payee info and the amount encoded in the URI-format. A customer with an account in Fineract CN then used a mobile app with a QR code scanner to scan the QR code and approve the payment with all funds getting transferred to and from the Fineract CN accounts via the Mojaloop APIs.

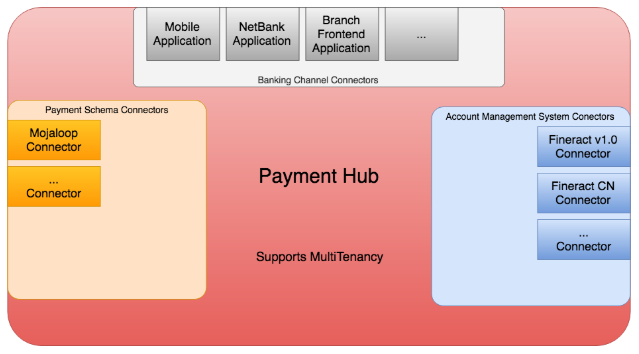

We’ve completed that use case and use case for a peer to peer push transfer. We await the remaining APIs for bulk transfer and merchant request to pay before completing those use cases. DPC designed and implemented a payment hub middleware which sits in between the core banking system and Mojaloop, abstracting the complexity of integrating with the Mojaloop APIs. The payment hub, and the integration with Mojaloop and Fineract APIs, has all been deployed in a containerized environment on AWS with two instances of Fineract and two instances of Fineract CN running.

The payment hub code is now available on GitHub and the requisite changes to Fineract and Fineract CN are ready to be discussed and reviewed before merging in. Read over the documentation on the design and how to implement the Payment Hub and Mojaloop integration.

We’ll soon be publishing a roadmap for the payment hub and Mojaloop integration so others in the community can get involved.

What’s Next?

While Arusha was the first time we’ve attended a Mojaloop community convening and we have only been working on Mojaloop for several months now, we have a clear vision of where we want to head and look forward to deeper involvement in the community.

We look forward to attending the upcoming Mojaloop community convening in Johannesburg in April, and are eager to explore how we can embark on our next phase in deepening the integration with Mojaloop and building out advanced capabilities in the Payment Hub. We are also actively working with the major players in the Mojaloop community to enable adoption including:

- Working with the DFS Lab in the coordination of their Mojaloop Hackathon this April – we have set up and configured a lab environment with Mifos and Fineract instances running as the DFSP system for hackathon lab participants with the aims of incorporating more of this into the long-term public Mojaloop lab environment.

- Exploring collaboration with ModusBox in South and Southeast Asia to advance the adoption of Mojaloop and L1P-compliant payment systems.

- We are discussing collaboration with WOCCU to advance Mojaloop-ready Mifos core banking systems as part of their digital financial inclusion strategy in Asia.

- We are in discussion with GSMA about ways to support their lab environment, integrated with the GSMA mobile money API, and explore the creation of a reference open source mobile wallet powered by Fineract and connected to Mojaloop.

Get Involved

For developers in the Mifos and Mojaloop communities, you can:

- Review the payment hub code and documentation

- Browse the Mojaloop Github and Docs

- Payment Hub is not only the point of integration with Mojaloop but any other 3rd party payment systems.

For those looking to adopt Mojaloop, deploy it in their region, or innovate on top of it, including: Mojaloop Adopters

- MFIs or financial institutions that wants to participate in a Mojaloop payment scheme and need to integrate their back office system

- Fintech eager to explore Mojaloop and leveraging its interoperable payment capabilities

- Governments or regulatory agencies exploring adoption of a modern payment system guided by the Level 1 Project principles

- Telcos and mobile money providers wanting to innovate on Mojaloop.

Contact me and we create you an account or a Fineract cloud sandbox on our Mifos Lab instance on AWS so you can test out the Mojaloop APIs using a working core banking system.