Meet Our Star Contributor for March 2015 – Ishan Khanna

Ishan entered The Mifos Community as a Google Summer of Code 2014 participant where he grabbed hold of Android Client and built out the native Android field operations app for Mifos X users. Over the course of last summer, Ishan took the community from no mobile app to full functionality. His work can be seen in the Mifos Android Client User Guide.

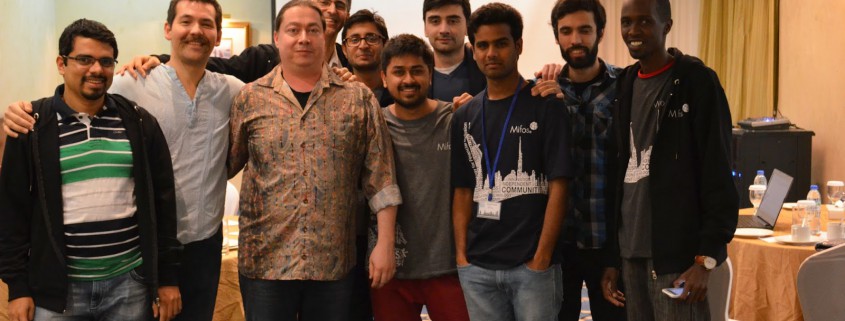

Ishan didn’t stop there. He has been active in the Community ever since – even though he has a full-time job with SeekSherpa. He has contributed major bug fixes and engaged others in the community. During the 2015 Summit, he made contributions to several partners including FINA in Georgia to help get their remote app to full functionality. Tengiz Merabishvili from FINA says, “Ishan helped us a bunch, he is a great developer. He is very energetic and knowledgeable. He is a hard worker and once he sets his mind to do something, he always gets it done. I enjoyed our brief time working together, and learned a lot.”

Ishan didn’t stop there. He has been active in the Community ever since – even though he has a full-time job with SeekSherpa. He has contributed major bug fixes and engaged others in the community. During the 2015 Summit, he made contributions to several partners including FINA in Georgia to help get their remote app to full functionality. Tengiz Merabishvili from FINA says, “Ishan helped us a bunch, he is a great developer. He is very energetic and knowledgeable. He is a hard worker and once he sets his mind to do something, he always gets it done. I enjoyed our brief time working together, and learned a lot.”

In Ishan’s own words, “I am an insatiable geek, striving for perfection in software. I love giving Tech Talks and motivating people about FOSS Development.” He has two and one-half years Android Platform experience. He has a gained good grip on Java, Android SDK, Git, Gradle and other related technologies in this period.

Q. On what projects are you currently working?

A. I’m working on an app that will allow travellers to connect with locals and change the way travellers see a city these days. TL;DR – Disrupting the Conventional Travel Experience.

Q. What is most rewarding about working with the Mifos Community?

A. The opportunity to meet, work with and learn from people in Global Mifos Summit, having experience in the industry more than my total living age. And to represent Mifos Initiative at Google Summer of Code Reunion in San Jose, California in October, 2014.

Q. How do you play when you aren’t working?

A. When I am not working I am usually digging into new frameworks, languages and tech blogs. Find food across the world through YouTube. Or watching “The Big Bang Theory”.

A. When I am not working I am usually digging into new frameworks, languages and tech blogs. Find food across the world through YouTube. Or watching “The Big Bang Theory”.

Perhaps painting his face in support of India while in Dubai slipped his mind. . .

Thanks Ishan for your contributions and your joyful spirit!

A. When I am not working I am usually digging into new frameworks, languages and tech blogs. Find food across the world through YouTube. Or watching “The Big Bang Theory”.

A. When I am not working I am usually digging into new frameworks, languages and tech blogs. Find food across the world through YouTube. Or watching “The Big Bang Theory”.