Google Code-In Grand Prize Trip

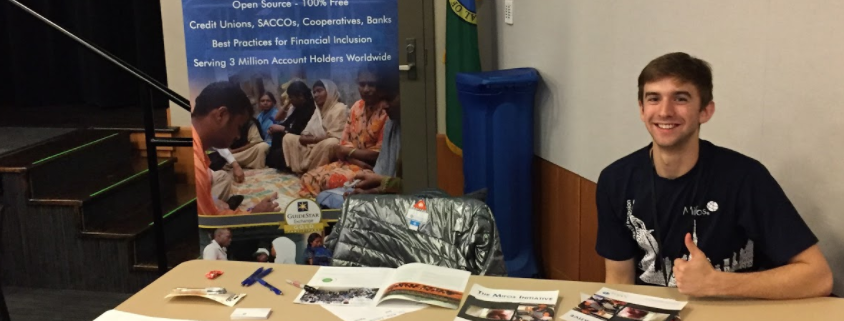

I remember the day, around 2 weeks before the GCI was scheduled to start, when I told Edward Cable, “Ed! I have my last semester exams from 15th November to 15th December. So I won’t be able to apply in GCI as a mentor!”. However, by the end of the week, I had realised that the organisation had given me a lot. So, I changed my mind and decided to give it a try!

During the GCI period, it was common for students to ask for help, so I talked to them, and discussed with them about various things like git and Android, helping them resolve their issues.

Believe me when I say, I wasn’t aware of the trip to Google until late January. I came to know about it from a friend, and my reaction was all surprised. “What! Which trip? Where? Where was this mentioned?”

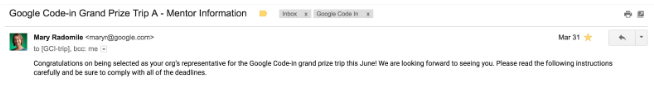

On 7th February, I got an email from my the head of my organisation, Edward Cable, stating that I had been selected for the Google Trip. The same was confirmed by Mary Radomile soon enough.

I was extremely excited to meet Stephanie Taylor, Mary Radomile and the Open Source team.

I was extremely excited to meet Stephanie Taylor, Mary Radomile and the Open Source team.

Dinner at Google San Francisco Office (Day 1)

Anubha, the mentor from an organization called Systers, and I started out day by meeting with Edward Cable, followed by a visit to the Facebook headquarters and the LinkedIn office, both being great experiences! We came back to Hyatt Regency, San Francisco, to meet the Google Open Source team.

Later that day, I met Stephanie Taylor, Helen Hu, Mary Radomile and Josh Simmons. I felt proud! Once we had all gathered in the hotel lobby and collected our badges, we went to the Google office. There, we met with Cat Allman, one of the core members of open source team. It was extremely great meeting each of them!

As if it wasn’t already great, all the students and mentors were given various goodies (T-shirts, stickers, notebooks and a jacket for mentors, an awesome backpack for the students). To top it all off, specially for a foodie like me, we got to dig into the awesome food at Google. We spent an hour, eating and talking to the other mentors I was with: Damini Satya, Milindu Sanoj Kumarage, Rostyslav Zatserkovnyi, Anubha Kushwaha, Ignacio Rodríguez, Sam Reed and Ben Ockmore. We interacted with various students present there, with their parents. It was a great experience, and a view of several cultures all at once. Read more