Fintech Forum: Loan Origination

For our latest round of the Fintech Forum, we’re combining several topics. At heart of this post is a guest blog from Gururag Kalanidhi of Habile Technologies looking at the Latest trends in Loan Origination. His post dovetails well with some of the research briefs that several of our GCI students did on digital credit.

For our latest round of the Fintech Forum, we’re combining several topics. At heart of this post is a guest blog from Gururag Kalanidhi of Habile Technologies looking at the Latest trends in Loan Origination. His post dovetails well with some of the research briefs that several of our GCI students did on digital credit.

This research and the guest blog post nicely complement a couple ongoing conversations we’re having across the community related to the product roadmap as a whole for Fineract CN and how our ecosystem is leveraging artificial intelligence, machine learning, and big data to make faster and better credit decisions while also delivering more impactful products and services.

To give your feedback on what you’d like to see in Fineract CN in general but also specifically as it relates to loan origination, please fill out this quick survey.

If you need some primers on digital credit and how it differs from traditional credit and lending procedures, these two research briefs from Chirag Gupta and Janice Kim on digital credit do a great job of highlighting the technologies underpinning digital credit, the benefits it enables, the challenges it cause, and a sampling of digital credit providers.

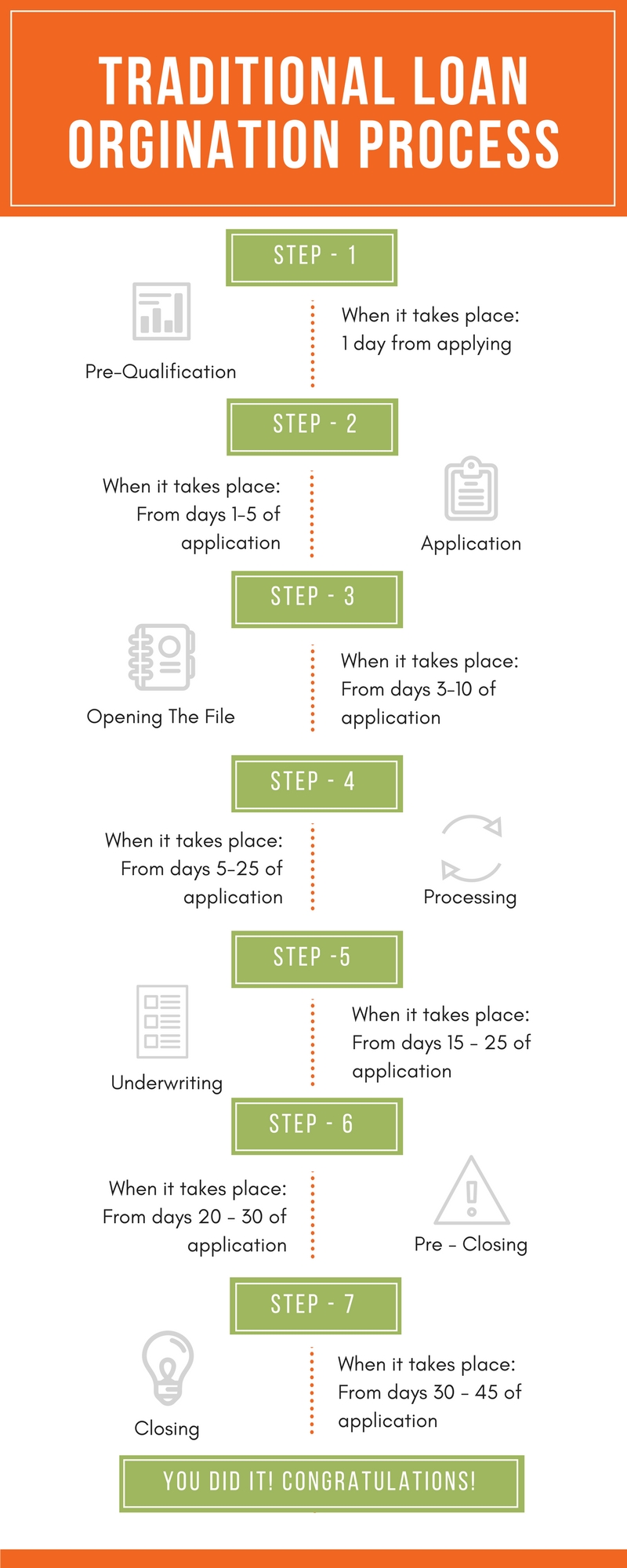

In their guest blog post, Habile looks at how technology can transform the traditional loan origination process. Here’s just a small snippet from their post looking at the traditional process and the technologies enabling digital loan origination:

Paperless Loan Origination:

Paperless Loan Origination:

Several lenders are taking efforts to gravitate towards a paperless loan origination system as it removes the many hassles involved in handling physical paper based loan application documents. Thanks to the advent of Saas, several companies are offering Paperless Origination Systems as a service and helping banks ease the dependence on the existing model.

eKYC:

eKYC is an Aadhaar-based paperless process for fulfilling KYC requirements mandated by the government. Using this technology has enabled lenders to obtain the entire profile of their borrowers using the Aadhar system. Since the Aadhar is centralised, it eliminates the possibility of users providing falsified information. eKYC completely eliminates paperwork and In-Person Verification processes.

Document Management:

When it comes to loan origination, the management and processing of documents with efficiency is highly vital. Thanks to the advent of Cloud, several technology providers offer services where the documents submitted by borrowers can be securely processed and stored on cloud servers. This eliminates the manual sorting and maintenance of documents.

An added advantage of such a technology is that all documents that are now stored onboard servers are digitally verifiable and can also be subjected to scrutiny using machine learning and image processing. Even the authentication of such documents can now be done digitally with remote “eSigning” by customers.

Reading SMS:

Most of today’s KYC accounts are linked to the phone numbers of customers. Hence, customers receive all their financial updates, bank information, career opportunities via SMSes. Analyzing the SMS history of customers can help lenders examine the behaviour of the borrowers and analyze their credit worthiness.

Social Media Behaviour:

This is yet another area where information about borrowers can be analyzed. Thanks to the world of smartphones and the internet, a majority of the population frequents social media platforms and maintains an active presence there.

From sharing information on their new gadget purchases to checking into fancy restaurants, netizens share a wide variety of their personal details on social media. This can be used to know more about the spending patterns of customers.

Data Scraping:

Online purchase information is a bountiful resource to reveal insights into customer habit. From analyzing the shopping trends of a customer to knowing their income sources, data scraping can allow institutions to find out how prompt a borrower is while repaying their loans. Institutions like CIBIL help lenders categorize the ability of a customer to repay their loans

Psychometric Test:

Psychometric tests are used to generate a socio-psychological profile of borrowers. These tests enable lenders assess the risk posed by a borrower and his intent to payback the loans. This coupled with the CIBIL score helps borrowers ensure a better loan-risk assessment and considerably reduce the credit risk borne by them.

Read the full post from Habile Technologies at https://habiletechnologies.com/blog/loan-origination-trends/.

Going Forward

We look forward to working with partners like Habile Technologies to define the modern technologies that will help the community to digitize loan origination unlocking cost savings, improved performance, reduced paper work, and better credit risk analysis of incoming borrowers. Join the discussion on the roadmap so we can know what needs to be built into Fineract CN to support top-of-the-line loan origination.