Announcing Mifos X 16.01: Loan Rescheduling, Loan Loss Provisioning, Floating Interest Rates, Variable Installments & Self-Service APIs

We’re delighted to formally announce the new functionality that’s been made available in Mifos X over the past several release cycles culminating in the Mifos 16.01 release shipped on January 12, 2016. We’ve added major new features which expand the breadth of our loan product offerings, improve risk management and monitoring of your portfolio, and enable your clients to take control of their financial services through self-service channels.

Read on below for a glimpse into the major new features including:

- Loan Rescheduling

- Loan Loss Provisioning

- Floating interest rate loans

- Variable Installment Loans

- Self-Service APIs

- OAuth/HTTPs toggling

In case you missed our 2016 Roadmap Webinar, check it out to learn more about what’s scheduled for development in 2016. For few details on the all the bugs and enhancements from this and the 15.12 releases, view the release notes.

Many thanks go out to all the contributors who made this release possible – especially our core team, partners like Musoni Services, as well as a number of new features that were worked on by volunteers in the community.

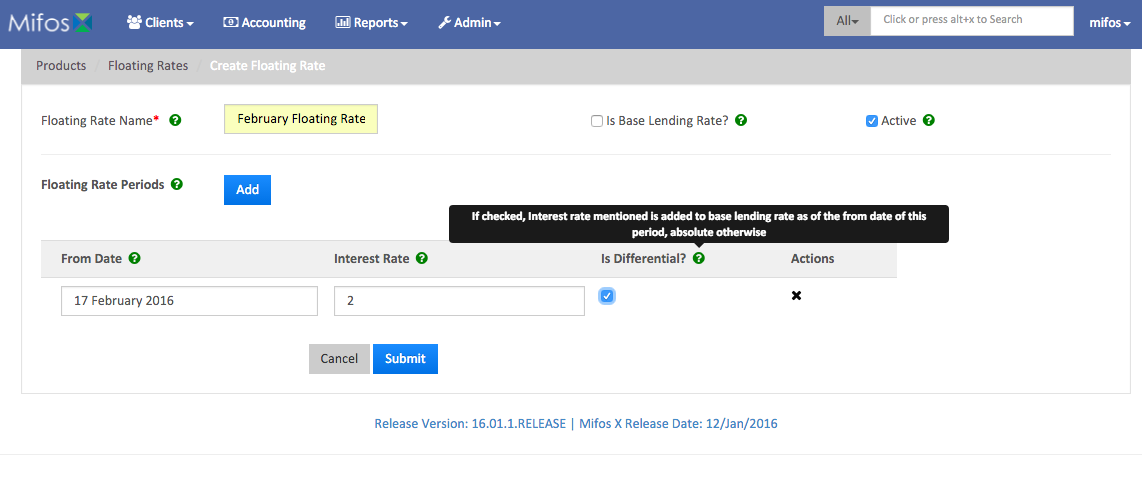

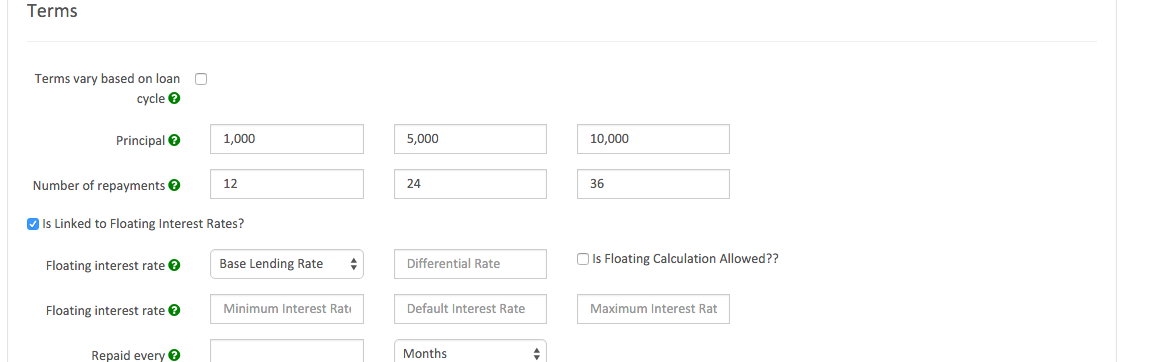

Floating Interest Rate Loans

Currently Mifos X only supported products with a fixed interest rate that couldn’t change during the tenure of the loan. Many users needed to offer products with variable interest rates that are linked to the base lending rate defined by their Central Bank.

Floating Interest Rates adds the ability to define a base lending rate and interest rate differentials to raise or lower the rate. These differentials can be in time-based interest rate bands.

Floating interest rates will only be applicable for loans with declining balance with interest recalculation.

View the Community App User Manual for documentation on how to fully configure floating interest rates.

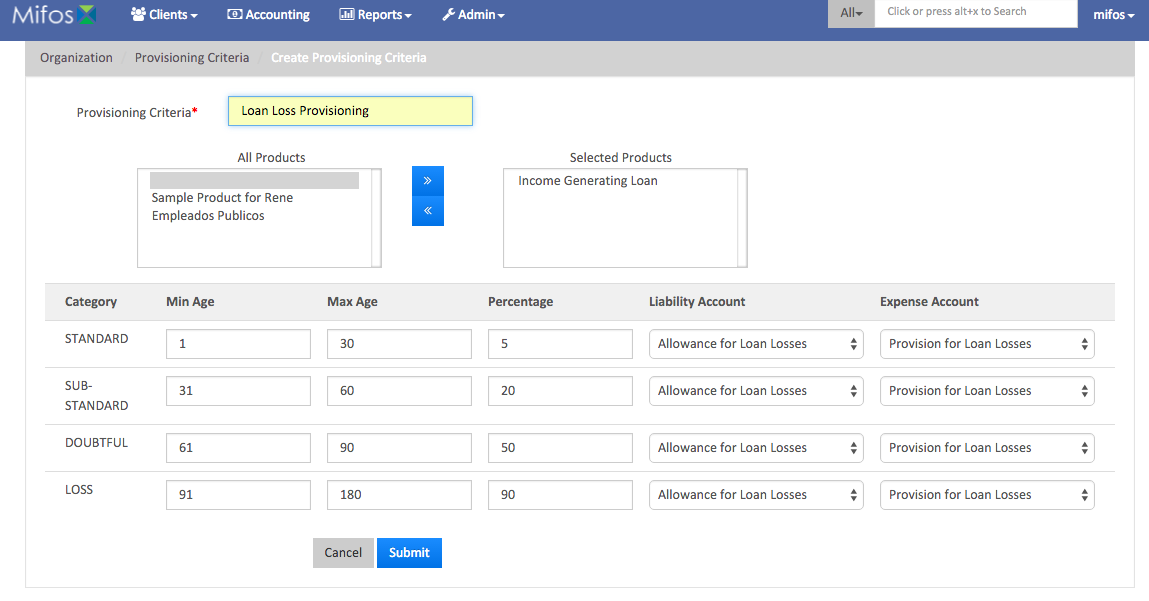

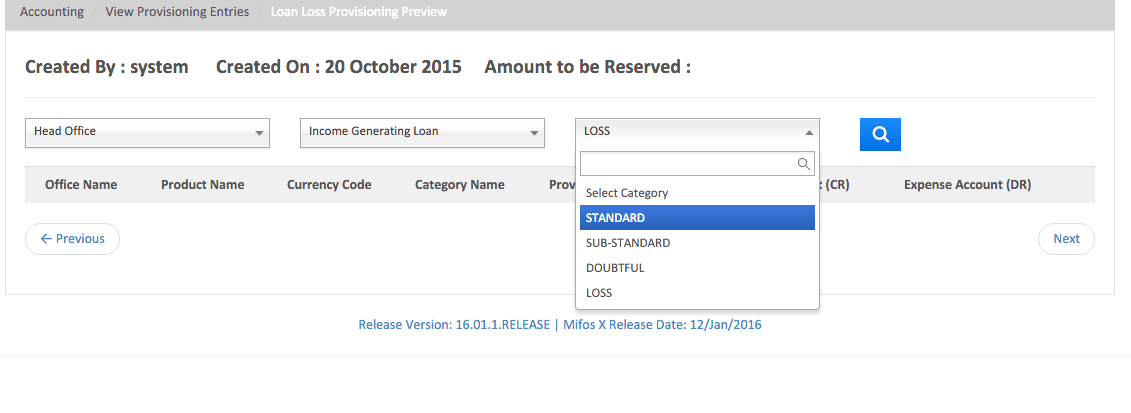

Loan Loss Provisioning

Mifos X now supports the automatic provisioning of bad debts/underperforming loans into their respective expense account for loan losses. The user can create four different categories for loan loss provisioning for any selection of loan products – Standard, Sub-Standard, Doubtful Loan, and Loss. For each of these four categories, the user can define the number of days a loan is overdue or in arrears, the percentage of the overdue amount that gets provisioned into the loan loss account, and the specific general ledger accounts that get debited and credited for each loan loss provision.

Provisioning entries are executed automatically via a Scheduler Job or can be executed manually. For each loan loss provision that is generated you can view an on-screen report which displays the amount of underperforming loans by each corresponding journal entry and their respective journal entries.

When a loan is deemed uncollectible, the contra account for loan lesses will be debited and the loan credited.

View the Community App User Manual for documentation how to configure Loan Loss Provisioning and view provisioning entries.

Loan Rescheduling and Restructuring

Rescheduling and Restructuring of loans has been a feature in high demand and will allow financial institutions to better manage their portfolio in arrears by giving their clients flexible options to maximize the possibility of recovery.

Thank you to the Musoni team for contributing the code-level changes to the Mifos X platform to support loan rescheduling.

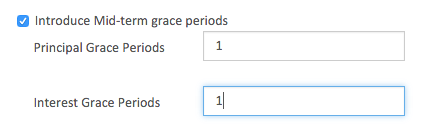

Four different scenarios to reschedule or refinance loans are now supported. One or all of the adjustments can be applied to a single loan.

- Change the Loan Term – Extension of the loan term by adding extra installments to the loan

- Change Installment Date – Change the due date of each future installments by X days (to allow shifting of days)

- Give Moratorium or Grace Period – Give the client an extra grace period of X installments to catch up on repayments

- Apply New Interest Rate – Adjust the interest rate for the remainder of the loan

Note: with the current implementation, a loan can only be rescheduled once. Rescheduling can’t be done for loans with interest recalculation or multiple tranches. Support for rescheduling or restructuring a loan multiple times is on the roadmap and can be accelerated if a partner or user is able to sponsor it’s development financially.

View the Community App User Manual for documentation on how to Reschedule Loans.

Variable Installment Loans

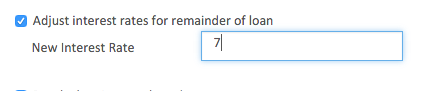

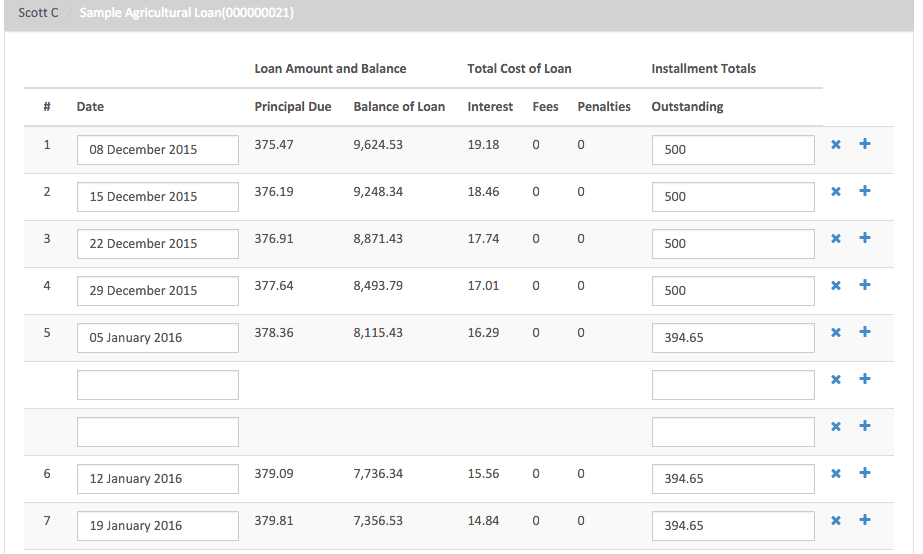

Many of the financial institutions using Mifos X need greater flexibility and control around the repayments schedule to support agricultural loans and other products that are more suited to the cash flows of the borrower. New support for variable installment loans allows for the dates, amounts, and number of installments in the repayment schedule to be manually configured prior to loan approval.

At the product level, one can now enable variable installments, and then specify the minimum and/or maximum gap that can be present between installments.

For each loan account with this setting enabled, the following can be manually configured in the repayment schedule prior to approving the loan:

- Adjust due dates of installments

- Add/remove installments

- Modify amount of the installments

One can validate all these changes and their impact on the loan interest prior to saving the change.

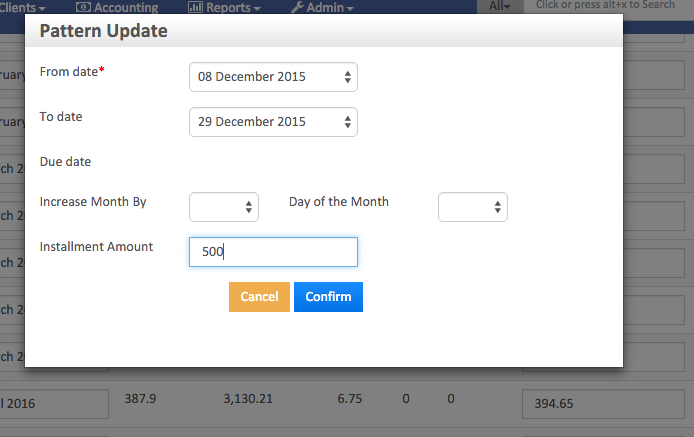

There’s also a handy feature to modify installments in bulk by following a pattern:

View the Community App User Manual for documentation on how to configure and use variable installments.

Self-Service Channels

One of the biggest improvements in this release is the development of self-service APIs which allow clients to log in and directly interact with their data in Mifos X.

This will open a whole new world of applications on top of the Mifos X platform. Mifos X is no longer just a core banking system for internal staff but can now power a multitude of self-service channels and mobile apps including online banking interfaces vai the web or smartphones, USSD or SMS apps for clients and mobile apps for external agents.

Self-Service APIs have been designed and implemented to allow the client to:

- Log in and authenticate themselves

- View their own loan or savings account details

- Transfer funds between their own accounts

- Transfer funds to other accounts of clients at the financial institution

Over the next quarter, we’ll be building out additional APIs and offering reference applications leveraging these APIs. Right now, we are excited to see the innovation our community is ready to build.

View the wiki for an overview of the APIs available.

OAuth2/HTTPs Toggling

With Mifos X 15.03, OAuth2 support had been added to complement basic HTTPs authentication but customers could only choose one method or the other. Support it now in place to toggle between the two.