Powered by Mifos – SoftiDoc

This regular blog series will showcase partners and the innovative solutions they’ve built that are powered by the Apache Fineract and Mifos X platforms. These case studies will demonstrate your solution to end users who are seeking to use them as well as show other partners in the community how they too can leverage the Apache Fineract platform to build their own solutions powered by an open source core banking infrastructure.

Traditionally lending has been a slow & complex process, filled with manual interventions. SoftiDoc’s technology aims to drastically change the loan disbursal process, bringing transparency, cutting down on the time & effort to grant loans. This is achieved by levering cutting edge AI & the banking solutions offered by Mifos.

SoftiDoc uses optical character recognition to read bank statements uploaded by users. These statements are then processed by machine learning models to assess the loan eligibility of the customer. All these services are tied together by Mifos, which provides all the traditional banking requirements from a digital disbursal to a digital ledger for seamless integration.

Business Meets Technology!

Overview of the Team/Company

SoftiDoc is an AI solutions provider specialising in a boutique of products to achieve financial inclusion. They specialise in application development & complex system integration leveraging artificial intelligence to address banking challenges and needs. SoftiDoc has leveraged MIFOS to develop a digital core banking system that incorporates their AI prebuilt boutique components.

SoftiDoc was started by Jeremy Engelbrecht in April 2020. Jeremy has a range of experience in the finance industry working in various roles through the years. He has a masters in computer, data science from the University of Liverpool. He has leveraged his experience & knowledge of Neural Networks to kick start SoftiDoc with 5 developers.

Reach/Impact of our Solution

In the short time since its inception, ~1 year, the platform has been adopted by multiple players in the finance industry, supporting $4MM+ USD in disbursals for thousands of customers. The ease of disbursal through the platform has also enabled SoftiDoc to maintain its own smaller loan portfolio.

Features of SoftiDoc

Customers seeking a loan are asked to upload a soft copy of their bank statements. Alternatively, SoftiDoc also has the facility to retrieve bank statements using credentials entered on it’s platform. This process is highly simplified compared to traditional methods where various income proofs and documents are requested.

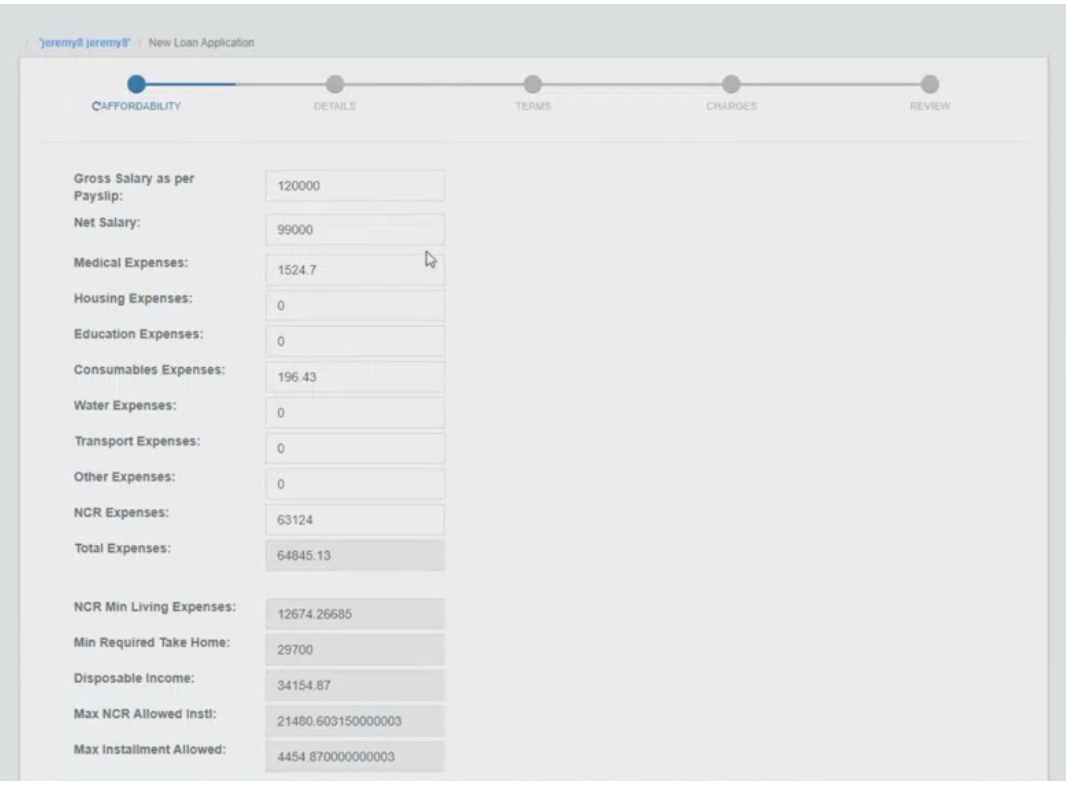

SoftiDoc then processes these bank statements to arrive at the loan amount that the customer is eligible for in a matter of seconds. This drastically cuts down on the turn around time to grant a loan & eliminates the need for manual intervention.

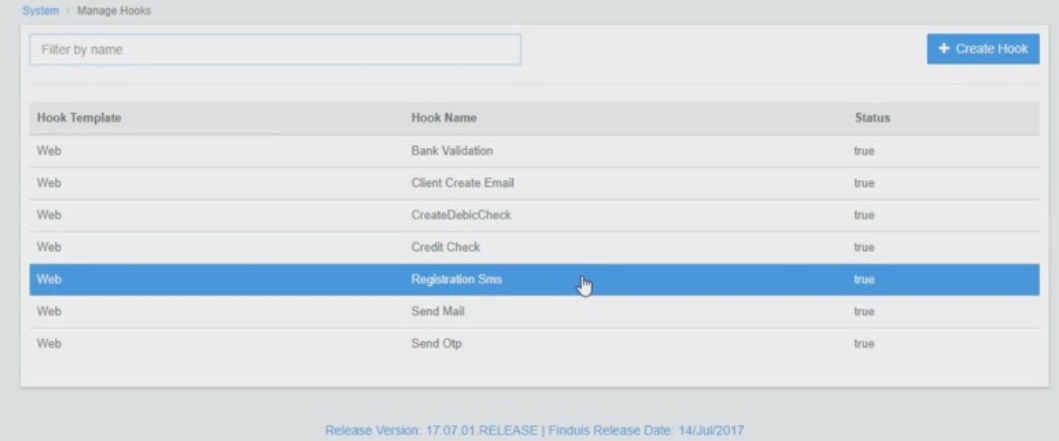

The AI behind these services are organized as different modules that work in tandem. These services are offered as SaaS to financial institutions that can adopt one or more of these solutions for their use cases

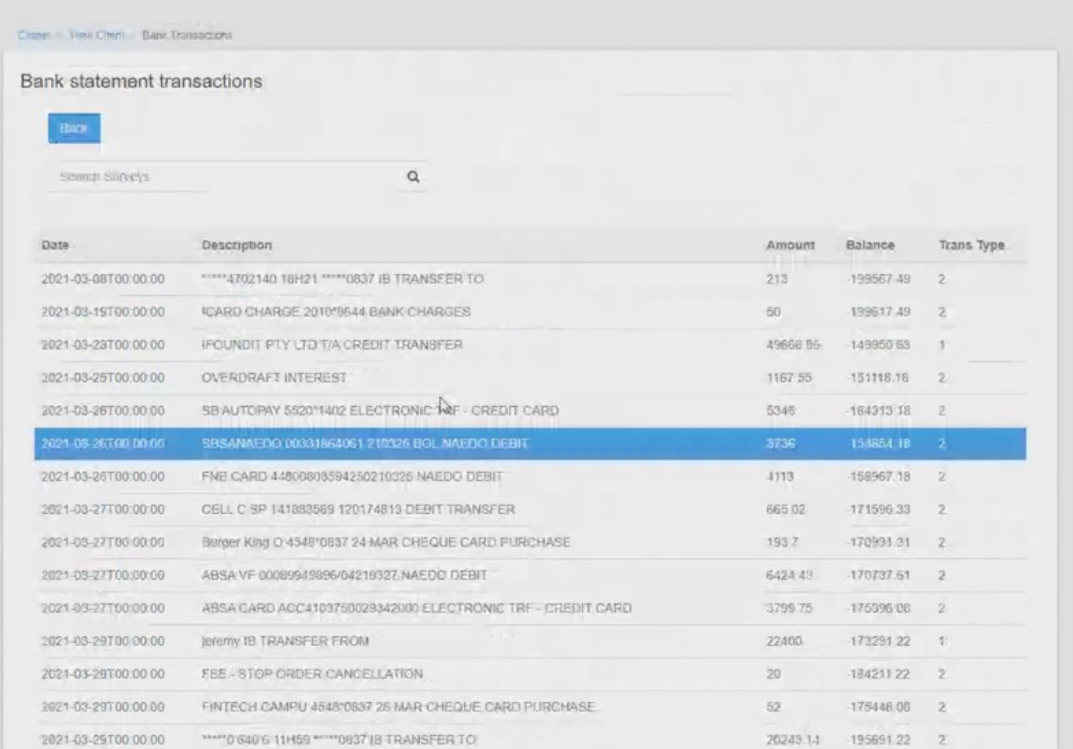

Processed bank statement in Mifos

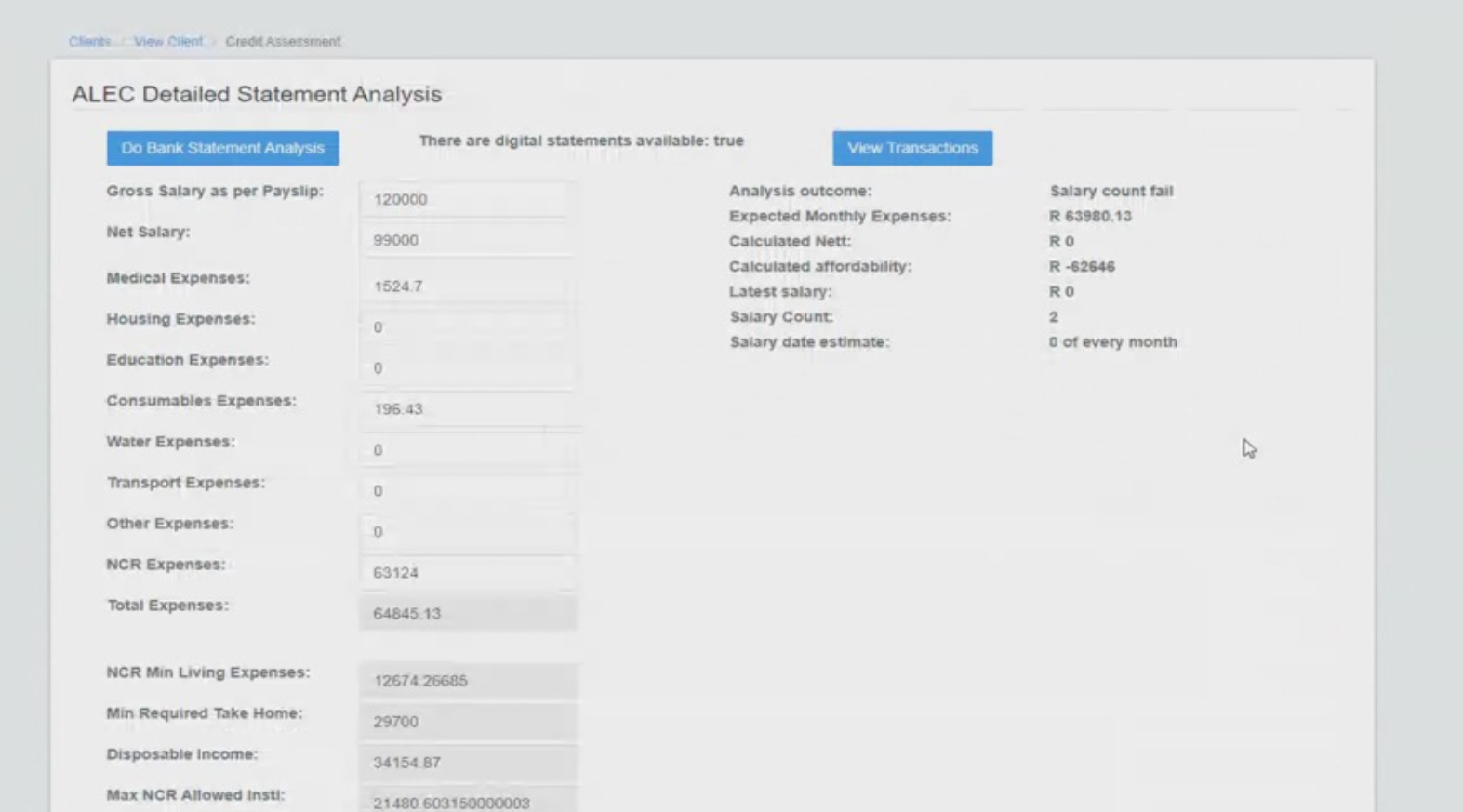

Sample results of AI fetched to Mifos

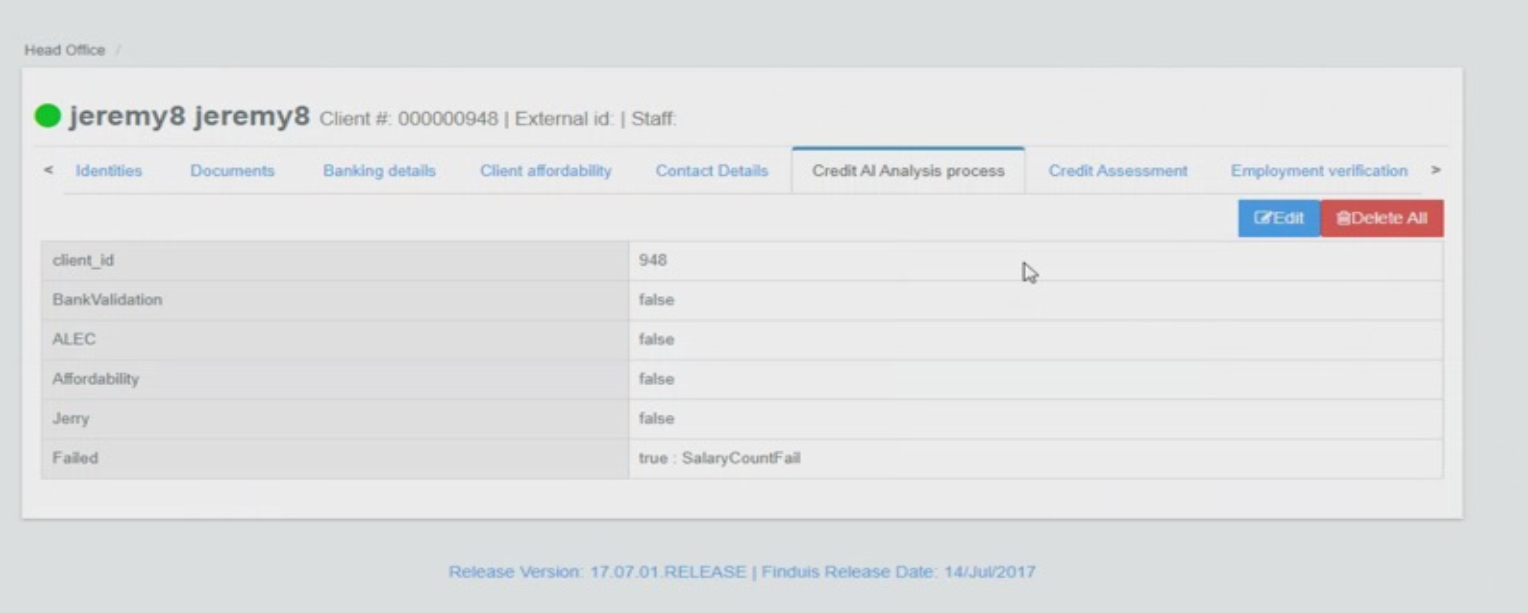

Sample results of AI fetched to Mifos

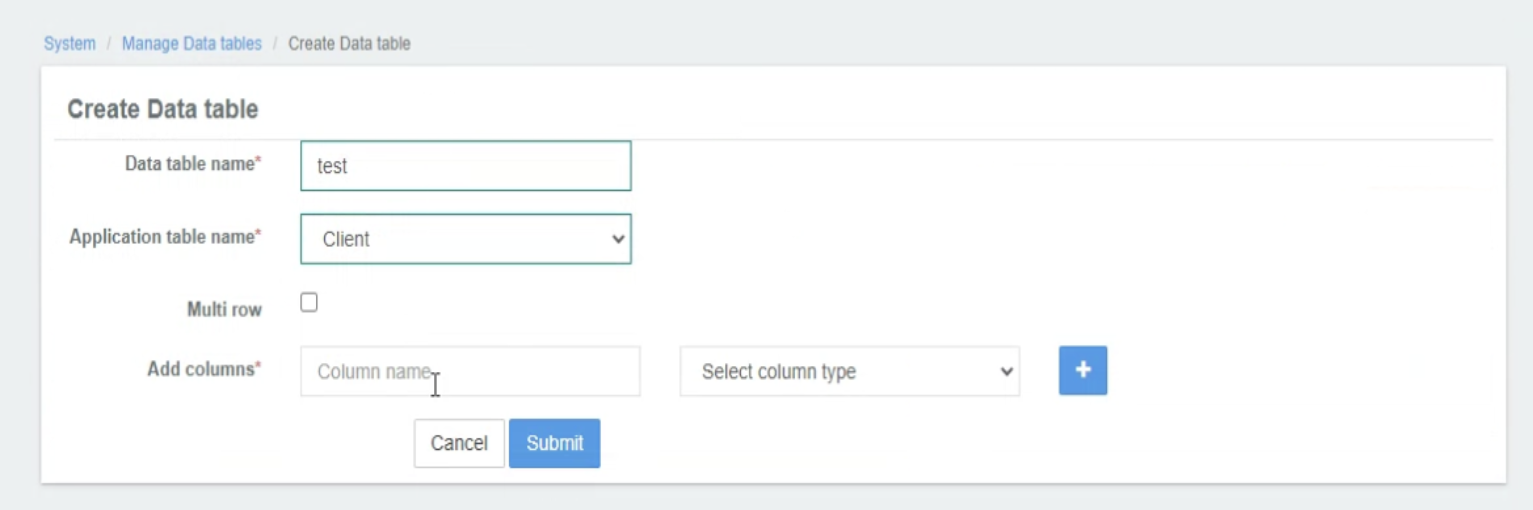

Usage of data tables in Mifos

How is SoftiDoc Powered by Mifos?

Mifos provides end to end open banking solutions that are highly customizable. Mifos brings together the various modules in this solution & ties them together for a complete & seamless solution.

SoftiDoc has integrated their AI modules into the Mifos X banking solution. Mifos provides the loan administrator facing layer where the results of various AI modules can be interpreted & acted on wrt loan disbursal. MIFOS also provides the digital ledger & portfolio maintenance backing the platform.

New loan disbursement process within Mifos

What were the benefits of using Mifos X and the Apache Fineract Platform?

Mifos is not only open source but it is highly customizable and hence lent itself very well to SoftiDoc’s use case. This has significantly cut down the go to market time & costs for SoftiDoc. However, the main feature is the event driven nature of the platform meant that the various AI services from SoftiDoc can be run seamlessly. If one of the services goes down, the event driven nature means that the event trigger to other services allows them to handle this & function accordingly. This has enabled SoftiDoc to get bigger & better.

“Mifos has provided me with a lot of resources & support to take my solution to market. I am enthusiastic about giving back to this community, would recommend Mifos – Jeremy Engelbrecht, CEO SoftiDoc”

Relevant Links

Website : https://softidoc.com/

LinkedIn: https://www.linkedin.com/in/jeremy-engelbrecht-6b154814b/?originalSubdomain=za