Powered by Mifos – RuPie

This regular blog series will showcase partners and the innovative solutions they’ve built that are powered by the Apache Fineract and Mifos X platforms. These case studies will demonstrate your solution to end users who are seeking to use them as well as show other partners in the community how they too can leverage the Apache Fineract platform to build their own solutions powered by an open source core banking infrastructure.

RuPie is a fintech startup providing self-service urban microfinance via micro-loans to semi-skilled workers and small business owners entirely on mobile phone.

Overview of the Team/Company

Nayan Ambali is the CEO of RuPie and a co-founder. As CEO he is responsible for strategic decisions and overall direction of the company, he also manages partnership relations. Nayan brings a total 12 years of banking and financial experience and specially around 8 years of rich experience in financial inclusion

Ramesh is RuPie’s Chief Operating Officer and is responsible for end-to-end management of loan portfolio. Prior to RuPie, Ramesh worked as operational head at HomeTriangle, managing around 500 service providers. Ramesh also worked with Yodlee, Redwood and played a key role in building a personal finance management platform.

Dhiru is the technical architect of RuPie’s tech stack. Previous to RuPie he worked with Arcot building 3D security and fraud detection for card payments then he moved to Komli Media, worked on digital footprint analysis and big data. Dhiru earned an Electrical Engineering degree from IIT Madras, where he was a college football team player.

We believe everyone deserves the ability to pursue more in life, We are committed to increasing financial inclusion around the world. We share our vision with Mifos Initiateve’s 3 Billion Maries and WorldBank’s UFA2020

Reach/Impact of our Solution

We started our operations in mid-August 2017 in North Bengaluru (Peenya and Yeshwantapur industrial sub-urban) and have had more than 10,000 app downloads. On a daily basis we get more than 100 new loan applications. As of today we funded more than a few hundred aspirations.

There is no equivalent stratification for us when we fund our customers’ aspirations and with that fund they are able achieve their dreams. We would like to mention two of our customer stories.

Mahadevaswamy

Mahadevaswamy migrated to Bengaluru for a better life from Mysore district’s Chidaravalli village. At present he works with Shahi Exports, a textile company, as a tailor. This year he decided to send his children to a better school and he was short of money for school fees and unable to find any financial institutions who would help him with small credit. In spite of spending few day visiting banks without any luck and ended up losing around three days of earning, he decided to give up his dream and pursue the same next year. In the meantime, RuPie was conducting a financial literacy program at Peenay industrial area and in that program he learned about the RuPie offering. Yet, he could not believe that someone would give him a credit through mobile app. His willingness to send his kids to a better school raised his hope to apply for a loan through the RuPie app. To his surprise he got a call from RuPie and his underwriting was done in less than 30 minutes and his loan got approved. There was no limit to his happiness for being able to send his kids to a better school.

Similar to Mahadevaswamy, Govindaraju moved to Bengaluru for a better job opportunity. He works as accountant in a manpower outsourcing company. His wife had taken tailoring course thinking of helping her husband financially. Govindaraju also had similar experience with banks but through one of his colleague he came to know about RuPie. He quickly downloaded the app and applied for a loan. RuPie was able to fund him to buy a Merritt sewing machine for his wife.

It is not just Mahadevaswamy or Govindaraju’s stories, but the potential stories to be told for around 120 million urban low income Indians who do not have access to credit from formal financial institutions.

Features of RuPie

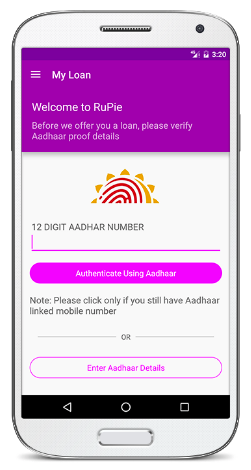

RuPie has a customer facing self-service android app whereby a user can fill out a simple form in under 30 seconds and submit for quick review,

RuPie has a customer facing self-service android app whereby a user can fill out a simple form in under 30 seconds and submit for quick review,

Our Aadhaar and mobile based credit scoring technology evaluate an applicant’s credit worthiness and generates personalized loan offers within minutes of downloading the App. The Loan will be delivered to the applicant’s bank account within just minutes of approval.

Within our platform, they can view loan status, get reminders and track payments. Integration with UPI and payment gateways, enables making or receiving payments instant and simple.

Our loan terms makes repayment easier than ever. By making timely repayments, fees decrease, and the client will be eligible to access greater loans with more flexible terms.

We take out the difficulties of getting a loan by utilizing the information on their mobile to make a financial assessment. We encrypt the data the client shares with us to protect their privacy.

How is RuPie Powered by Mifos?

All of RuPie’s transactional information uses Apache Fineract’s core components like LMS (Loan Management System), ledger book keeping (Financial accounting) and customer management.

What were the benefits of using Mifos X and the Apache Fineract Platform?

We got a huge tech leap and easily can say Fineract put RuPie almost a year ahead in terms of technology, letting us focus more on building RuPie’s core technology. Fineract is not just a piece of open source banking software, Finract is a mission, it is community of like-minded, committed people around the globe with whom we are dreaming of a world with zero poverty. The community has great working knowledge on financial inclusion around the world. Through community we get to learn about how financial inclusion is done in a better way, success stories and what worked in other countries and what did not work.

Having Apache Fineract as a solution for our core banking system, we were able to focus more on building components that were the reason to start RuPie. Our tech team was able focus more on building alternative credit score, integration with IndiaStack components like Aadhaar, e-Sign and UPI for cashless, paperless and presence-less transactions.

“We got a huge tech leap, I can easily say that Apache Fineract and Mifos X put RuPie almost a year ahead in terms of technology and letting us focus more on building RuPie’s core technology”

Visuals and Screenshots & Relevant Links

Logo: https://goo.gl/zG4Hra

Website : http://www.rupie.co/

Facebook: https://www.facebook.com/rupie.co/

Twitter: https://twitter.com/myrupie

LinkedIn: https://www.linkedin.com/in/nayanambali/

Team Photo: https://goo.gl/vs1oxQ