Mifos 2.6 (Esha K) is Live

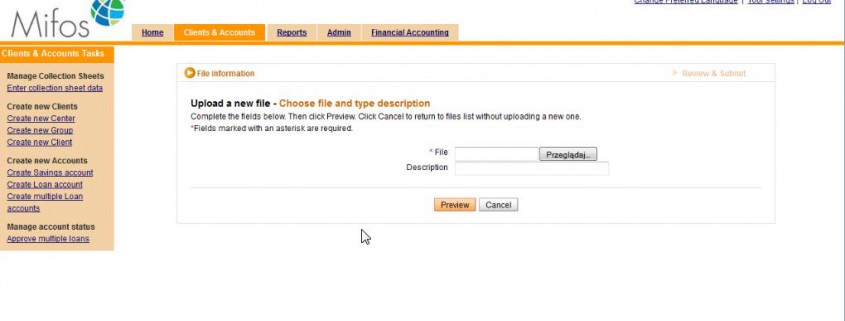

As we close out 2012 and bring in 2013, we are excited to roll out the final major release on top of the Mifos 2.x codebase. With its fourth major release, SolDevelo has wrapped up Esha K, our Mifos 2.6 release. The theme of Mifos 2.6 was to fill any major outstanding gaps and make Mifos 2.6 be the most polished and well-rounded application for group lending before we transition development to our lighter, more flexible, next-generation platform Mifos X. Major new functionalities include support for daily loans and savings accounts, the ability to upload and attach files to loans and clients, a user interface for modifying the chart of the accounts, a dashboard of key business metrics on the homepage, and enhancements to importing data in Mifos.

Apart from these many new features, more than 45 bugs were also fixed by the SolDevelo team. We will also soon be shipping as separate releases enhancements to accounting and reporting – Hugo Technologies has completed a range of enhancements to the Mifos-ACC accounting module and Conflux Technologies will be delivering a few additional standard reports to our Business Intelligence Suite. Please join us in thanking Lukasz C, Natalia, Kasia, Kamil, Wojciech, Pawel, Grzegorz, Marcin, Jakub P, Jakub W, Lukasz W and the rest of the SolDevelo team who led the development of these new features and helped to review incoming contributions.