Savings Accounts

Savings accounts can be created for saving products already defined in Mifos; they inherit the rules and defaults from the product definition. For example, a minimum deposit may be required before an account can earn interest. Savings accounts can be created for an individual or a group or a center, depending on the definition of the product. When a user creates a client account, he can choose to automatically create up to three savings accounts for the client at the same time.

A savings account can be created only if the product is in an Active state and the client or group is Approved or the center is Active. Accounts can be either mandatory or voluntary, depending on how the Recommended/Mandatory amount for deposits attribute is set.

Group/center savings accounts. By default, all members of a group/center are part of all the savings accounts of the group. These members are allowed to deposit and withdraw from the group/center savings account. When a transaction (deposit/withdrawal) is made, the user selects the client name from a list of Approved clients belonging to the group/center. The deposits/withdrawals can also be made by a non-specified entity.

A center, group or client can have multiple accounts of the same or different products but a single account cannot be given to multiple centers, groups or clients. Individual client accounts cannot be converted to a group account. Similarly, a center/group account cannot be converted.

Savings accounts cannot be deleted.

Notes on savings amount:

- This amount is considered “due” at every meeting day of the account owner. Partial payments are allowed.

- For mandatory accounts: If a deposit is not received as expected on a meeting day, it is added to the due amount for the next meeting day. That is, the account owner will owe double the amount at the next meeting day.

- For voluntary accounts: If a deposit is not received as expected on a meeting day, it will not be added in the due amount for next meeting day.

- For center accounts: this amount is applied to all clients in Active or On hold states.

- For group accounts where the amount applies to per group member: this amount is applied to clients in Active or On hold states.

Attributes for savings accounts

In addition to the attributes inherited from the savings product definition, the following attributes are defined for savings accounts. Attributes that are defined at the product definition level but can be modified at the account level are repeated here.

| s. no. | attribute name | data type | default value | mandatory state = partial/ pending | editable after state = approved | partial | pending | approved | range | notes |

|---|---|---|---|---|---|---|---|---|---|---|

1 | Account Owner (client/ group/center) | String (System ID) | None | Yes | Yes | No | No | No | All clients and groups in Approved Status; All centers in Active state |

|

2 | Savings Product Name | Drop Down | None | Yes | Yes | No | No | No | Savings Products in active state |

|

3 | Recommended/ Mandatory Amount for Deposits | Number | Inherited from product definition | No | No | Yes | Yes | Yes |

|

|

4 | Status | Radio Buttons | N/A | N/A | Yes | Yes | Yes | Yes |

| The field will be called "Mandatory amount for deposits" for Mandatory Accounts and "Recommended amount for deposits" for Voluntary accounts." Mandatory for "Mandatory Accounts" and Optional for "Voluntary accounts." See note on this field below. |

5 | Flag | Drop Down | None | N/A | N/A | N/A | N/A | N/A |

| For canceled state, flag options are: Withdrawn, Rejected, Blacklisted, Other |

6 | Notes | Text |

|

|

|

|

|

|

| Can be added from the account details page |

7 | Question Groups | Mix | None | No | No | Yes | Yes | Yes |

| See Question Groups |

Savings record states

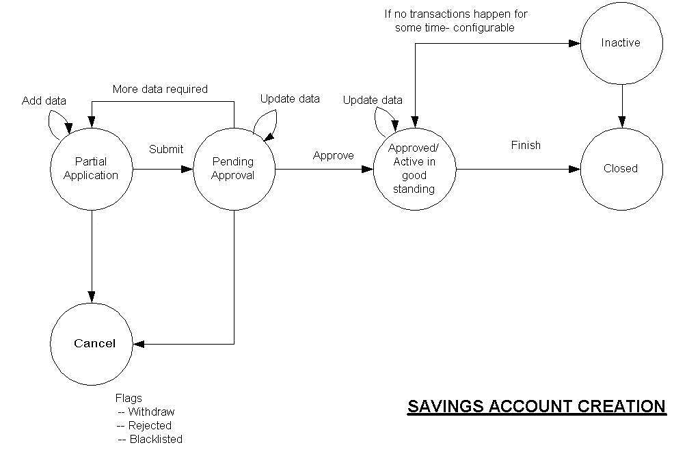

When a savings account is created, it is processed through various states, as illustrated below. A user with appropriate permissions manually changes a savings record state in Mifos, using a checklist [link] if one has been defined by the MFI. Mifos validates the fields as described in the attributes table [link]. However, external MFI processes and business logic are not validated.

Every change in state is entered in the change log, along with the date and user ID of the user making the change [link to change logs].

[Figure 1: Status Flow Diagram- Savings Account Creation]

As illustrated, a savings record can reside in the following states. All states are mutually exclusive:

Table 2: State Description for Savings Accounts

status | description |

Partial Application (save for later) | If the record has been created but data is incomplete or the user does not want the state to be Pending Approval, the state can be marked as Partial Application. The account attributes can be updated/modified in the Partial Application state and Pending Approval states, as per the attributes table. Deposits/withdrawals are not allowed in this state. |

Pending Approval | This is an optional state, depending on the MFI. The record contains all necessary data, and is waiting for approval. Offline processes, specific to each MFI, might govern the approval process but do not impact Mifos functionality. Deposits/withdrawals are not allowed in this state. |

Active | The savings account has been approved and the client can use their savings account. An account can remain Active with a nil balance. |

Inactive | If there are no transactions in the savings account for X days (X is the dormancy definition defined by the MFI), the state is automatically changed to Inactive. There are no restrictions on deposits, withdrawals, and adjustments while the account is in this state. If a transaction is made, the state automatically changes to Active. These state changes (from Inactive to Active and vice versa) can also be made manually. If an account is Inactive, no voluntary/mandatory deposits due appear in the collection sheet/bulk entry form. Mandatory amounts due stop accumulating but the amounts already accumulated in the account remain. (This is currently not working due to Issue 1911). |

Cancel | A savings application can be cancelled for to various reasons: client withdraws their application; the application is rejected by an officer of the MFI; the client is not eligible because he/she has been blacklisted. Deposits/withdrawals are not allowed in this state. |

Closed | Savings account is Closed. Once closed, the state of the account cannot be modified. Transactions are not allowed after an account is closed. When an account is closed, the interest till the current date should be calculated and posted to the account. Because the balance of the account must be nil before it can be closed, a withdrawal transaction must be made. The user must specify the Date of transaction (current date) and the Amount (total account balance including the interest earned till the current date). This amount must be rounded as per the rounding rules. The user must also specify the mode of payment, receipt ID and receipt date, and well as the client name. For group/center savings accounts, the client who made the withdrawal should also be specified. |

Savings account details

Once the user identifies the owner of the savings account, selects the product, and enters a savings amount, he/she previews the set of information associated with the savings account, on a single screen. This is a mandatory step. When the user approves the preview page, the savings account is saved in the database and an account number is assigned.

When a savings account has been created, its information can be viewed and edited on the account details page.

Account balance summary

Near the top of the page, the Account balance is displayed, which is calculated as: Deposits – Withdrawals + Interest Earned. This information is not available for accounts in Partial and Pending states. The total amount due and the date are also displayed.

For mandatory accounts only, click the View all account activity link to see a breakdown of the deposits made.

Under Performance History, the account details page also includes a summary of the account balance, as of the last transaction/interest posted. It includes the following:

- Total deposits (includes adjustments)

- Total interest earned (includes adjustments)

- Total withdrawals (includes adjustments)

- Adjustment if any - out of scope

- Account balance - out of scope

- Date when account was opened

- Missed Deposits

Deposits due. The account details page also displays the details for the deposit due on the next meeting date. The details included in this section are:

- Original deposit: amount scheduled to be paid on the next meeting date

- Past deposit due: amount overdue from past meetings with the break up of amount for each meeting date

- Total amount due on the next meeting with the next meeting date

Note that the original deposit and the total overdue amount can be waived.

Account details

The following attributes are displayed as read -only information:

- Recommended amount of deposit

- Type of deposit

- Maximum amount per withdrawal

- Interest rate