Loan Accounts

Loan accounts can be created for all Active products in the system; they inherit the rules and defaults from the product definition. Loan accounts can be created for either an individual or a group, depending on whether the product is defined for clients or groups. A group or client can have multiple loan accounts but a single account cannot be given to multiple groups or clients.

Loan accounts can be opened only for Approved/Active clients and groups.

Fees can be charged to loan accounts in three ways, both at time of account creation and after.

- Fees are inherited from the product definition. The LO can remove one or more of these fees for a particular account. If a fee is removed from an account, it does not affect other accounts.

- Predefined fees (not yet associated with the account) can be selected and attached to the account.

- Miscellaneous fees (one time charge) can be charged to an account. The user specifies the amount, which is added in the next payment.

Loan accounts can be created by clicking the Open new loan account link in the Quick Start navigation pane on the Home tab. A user with appropriate permissions will then need to then identify the client or group for which the loan is being created and select the loan product that will define the loan.

Attributes for Loan Accounts

The loan product attributes are inherited from the product definition. The defaults for some attributes can be overwritten at the account level as long as the new value remains within the min/max range defined in the product definition.

| Mandatory for State= | Editable after State= | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| S. No. | Attribute Name | Data Type | Default Value | Partial/ Pending | Approved | Partial | Pending | Approved | Range | Can be disabled? | Configurable/ Mandatory/Optional | Description/ Notes |

| 1. | Account Owner | String Un-editable, chosen from search results | N/A | Yes | Yes | No | No | No | Search results of list of Approved clients in the system | No | Mandatory | |

| 2. | Purpose of Loan | Drop-Down | None | No | No | Yes | Yes | Yes | Options as defined by HO | No | Optional | |

| 3. | Loan Name | Drop-Down- single select | None | Yes | Yes | No | No | No | All products in the status “Active” and Applicable to the “Account owner type” | No | Mandatory | If Account Owner is a client, products applicable to “Clients” will be displayed in the Loan product list. Similarly for groups. |

| 4. | Loan system ID | N/A | N/A | Yes | Yes | N/A | N/A | N/A | N/A | No | Mandatory | Un - editable- system generated |

| 5. | Loan Amount | Number | If specified, inherited from product definition. | Yes | Yes | Yes | Yes | No | Min/Max amounts as defined in product definition | No | Mandatory | |

| 6. | Interest rate | Percentage | Inherited from product definition | Yes | Yes | Yes | Yes | No | Min/Max rate as defined in product definition | No | Mandatory | The rate field can be zero, but cannot be left blank. |

| 7. | Number of installments | Number | Inherited from product definition | Yes | Yes | Yes | Yes | No | Min/Max installments as defined in product definition | No | Mandatory | |

| 8. | Disbursal Date | Date | Next meeting date | Yes | Yes | Yes | Yes | Yes | Any date – in between the loan approval date and one year from the current date. | No | Mandatory | This date is used as a Loan Start Date to generate the repayment schedule. The user can fill this field at the beginning of the loan to project when loan is disbursed; but this field can be updated anytime before disbursement. |

| 10. | Grace period for repayments | Number of installments | Inherited from product definition | No | No | Yes | Yes | Yes | 0; Min/max number of installments | No | Mandatory (if grace period is specified) | If grace period type (as per product definition) is “None”, OR, If Interest is deducted at disbursement, then this field is disabled. If the loan account is still in grace period, the length of grace period can be extended or reduced. It cannot be reduced for the period already crossed. For example, if the grace period is for three installments, and when the account is at 0.5 installments, it cannot be reduced to one installment, but can be reduced to two installments. |

| 11. | Fee types | List | Inherited from product definition | No | No | Yes | Yes | Yes | Predefined fee types | No | Optional | Only those fee types for which periodicity aligns with the repayment frequency can be attached to the account/ product. Seefees for details. |

| 12. | Source of Fund | Look-up, single select | None | No | Yes | No | No | No | Inherited from the product definition | No | Mandatory | |

| 14. | Collateral Type | Drop down- single select | None | No | No | Yes | Yes | Yes | Options defined by HO | No | Optional | Mifos system does not link these accounts; neither does it perform any validations for balance, validity, etc. of the savings account. |

| 15. | Collateral Notes | Text (200) | None | No | No | Yes | Yes | Yes | N/A | No | Optional | System allows only a single Collateral Note This note can be edited multiple times, but the system displays only the last saved Collateral Note |

| 16. | Status | Drop-Down | N/A | N/A | N/A | N/A | N/A | N/A | Refer Status flow. | No | ||

| 17. | Flag | Drop-Down- single select | None | N/A | N/A | N/A | N/A | N/A | Rejected; Withdrawn; Other | No | Mandatory | Applicable only for status= Cancelled |

| 18. | Question Groups | Mix | None | No | No | Yes | Yes | Yes | See Question Groups. | |||

| 19. | Notes | Text Field (500 char) | None | No | No | Yes | Yes | Yes | N/A | No | Optional | An account can have multiple "notes" attached to it. |

| 20 | External ID | Text Field | None | No | No | Yes | Yes | Yes | N/A | No | Optional | External ID is not enforced as unique. |

| Account Balance Details- System calculated Uneditable fields | ||||||||||||

| 20. | Principal Paid | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total principal paid by the client/ group till date | |

| 21. | Interest Paid | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total interest paid by the client/ group till date | |

| 22. | Fees Paid | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total fees paid (all fee types) by the client/ group till date | |

| 23. | Penalty Paid | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total penalty paid by the client/ group till date | |

| 24. | Total Amount Paid | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total amount paid (principal + interest + fees + penalty) by the client/ group till date | |

| 25. | Principal Remaining | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total principal to be paid from the current date till the end of the loan period. This includes any missed installments. | |

| 26. | Interest Remaining | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total interest to be paid from the current date till the end of the loan period. This includes any missed installments. | |

| 27. | Total Amount Remaining | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total amount to be paid from the current date till the end of the loan period +principal + interest). This includes any missed installments. | |

| 28.. | Principal Overdue | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Principal overdue (from previous installments) | |

| 29. | Interest Overdue | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Interest overdue (from previous installments) | |

| 30. | Fees Overdue | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total fees overdue from the previous installments. This is calculated as sum of all fee types charged to the account. | |

| 31. | Penalty Overdue | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total penalty overdue | |

| 32. | Total Amount Overdue | Number | N/A | N/A | N/A | N/A | N/A | N/A | No | Mandatory | Total amount overdue. This is the sum of overdue (principal, interest, fees, and penalty). | |

| Attachments | ||||||||||||

| 33. | File | Alphanumeric | No | Yes | Yes | Yes | Yes | Yes | 2 MB | No | N/A | Ability to type directory of file to attach. |

| 34. | Description | Alphanumeric | No | Yes | Yes | Yes | Yes | Yes | 60 characters | No | N/A | This field enables to add description of uploaded file. |

Loan record states

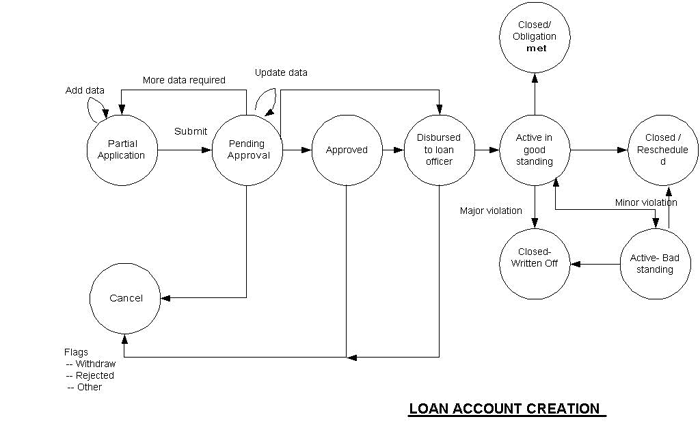

When a loan account is created, it is processed through various states, as illustrated below.

If a checklist has been defined by the MFI, this checklist will appear when changing the loan state [see Checklist]. Every manual change in state is entered in the change log, along with the date and user ID of the user making the change [link to change logs]. Note that some state changes (moving from Approved to Active in Good Standing, between Active in Good Standing and Active in Bad Standing, and moving into Closed/Obligation Met) are handled automatically by the system. These state changes are automatically triggered when a loan is disbursed, a payment is missed, etc.

If the HO does not include the optional states Pending Approval and Disbursed to LO, the status flow diagram looks like the following (Note: because we haven't thoroughly tested MIfos with these optional states turned off, we do not recommend removing these states): (Disbursed to LO state has been removed)

As illustrated, a loan record can reside in the following states. All states are mutually exclusive:

Status | Description |

|---|---|

Partial Application (Save for later) | This state is used if the record has been created, but data is incomplete or the user does not want submit the record for approval. |

Pending Approval (Submit for Approval) | This is an optional state and can be omitted during configuration. This state is used when the record contains all necessary data and is waiting for approval. Before and after this point, there may be offline processes which might govern the approval process. These processes can be specific to each MFI and does not impact Mifos functionality. |

Approved | Loan amount and repayment schedule has been approved. Once a loan account is approved, interest, amount, loan term, funding source, etc are frozen. These parameters cannot be changed. |

Disbursed to LO | This is an optional state and can be omitted during configuration. Mifos ships with this state turned off and we recommend not changing this default setting. Loan amount has been disbursed to the LO of the customer. While loan is in this state, it can still be cancelled. |

Active in Good Standing | Once the loan has been disbursed to the customer, the state will be changed to Active in Good Standing automatically by the system. Any applicable grace period starts from this point. If the disbursement date is different from the date originally entered, the repayment schedule will be regenerated. |

Closed - Obligations met | The system moves accounts into this state automatically when a loan amount is completely paid off. This state change cannot be manual. |

Closed - Rescheduled | Due to some reason, if the customer is unable to repay the loan on time, he or she can request for loan rescheduling. If MFI allows rescheduling, the current loan account has to be closed with the status marked as Closed- Rescheduled and a new loan account has to be created which can have the same or different conditions and rules compared to the previous loan. Mifos system does not link the old and new accounts. In performance reporting and other reporting, this loan is not counted; counter should be decremented. If this loan is included in the loan cycle, it should be removed from there when the loan account status is changed to Closed- Rescheduled. |

Active- Bad standing | Due to violations and/or non-repayment etc, the customer loan account can be marked as “Active- Bad standing”. From this state, customer account can go to “Active in good standing” or “Closed - Written Off”. System will move the loan account to this state automatically, in case it exceeds the “Definition of lateness” as defined by the MFI i.e., system has not received any payment for X number of days. (X is the lateness specified.) System will move the account back to the “Active in good standing” status when the total amount overdue has been paid (the complete principal overdue + interest overdue + fee overdue+ penalty overdue has been paid). The state change from “Active in good standing” to “Active in bad standing” and vice versa will always be automatic. Manual change will not be allowed. |

Closed- Written Off | If the MFI/LO determines that the customer cannot repay or has no intentions to repay the loan, the loan can be “Written off”. Transactions cannot be applied to accounts in this state. |

Canceled | A loan application can be cancelled due to various reasons like,

|

Notes:

- If users build reports to query on all active loans, they should query loans in both “Active in good standing” and “Active in bad standing” states. Similarly, if they build reports to query on all closed loans, they should query loans in both "Closed- Obligation Met" and "Closed- Written Off" states.

- There is no “Deleted” status. All accounts are kept in the system.

- There is no restriction on the number of times an account status can be changed.

- When an account is created, it can be either saved in Partial Application state or Pending Approval state. If Pending Approval (an optional state) is not included by the HO, new account can be saved in Approved state. [Note, this hasn't been thoroughly tested]

- A Checklist might be displayed before an account status is changed. This is to remind the users of the offline processes required before an account status can be changed.

Status History

Mifos automatically tracks changes in the loan/savings status. The first entry in this history should be the creation of the loan/savings and should show the change of status from New to Open, while the last entry should be the transition of the loan/savings to a final state of either Closed or Canceled.

This information can be used to track performance of the LO or efficiency of the MFI’s processes by tracking duration between loan/savings statuses.

The following attributes are captured when the status is changed and saved. All these fields are mandatory, un-editable, and generated by Mifos system.

| S. No.

| Attribute Name

| Data Type

| Description/ Notes

|

|---|---|---|---|

1. | Old Status | String |

|

2. | New Status | String |

|

3.. | Date Changed | Date | This is the system date when the status is saved into a new status. |

4. | Changed By | String | This is the username of the system user who performed the change in status. |

Note: All status changes, irrespective of number of times these statuses have been changed, are recorded in the status description table.

Status Descriptions for Loan Accounts

Status | Description |

|---|---|

Partial Application (Save for later) | This status is used if the record has been created, but data is incomplete or the user does not want the status to be Pending Approval, status can be marked as Partial Application. The loan account attributes can be updated/modified in Partial Application state and Pending Approval state as per the attributes table. |

Pending Approval (Submit for Approval) | This is an optional state and can be omitted during configuration by the HO. This status is used when the record contains all necessary data and is waiting for approval. Before and after this point, there could be some offline processes, which might govern the approval process. These processes can be specific to each MFI and does not impact Mifos functionality. |

Approved | Loan amount and repayment schedule has been approved. Once a loan account is approved, interest, amount, loan term, funding source, etc are frozen. These parameters cannot be changed. |

Disbursed to LO | This is an optional state and can be omitted during configuration by the HO. Loan amount has been disbursed to the LO of the customer. While loan is in this state, it can still be cancelled. |

Active in Good Standing | Once the loan has been disbursed to the customer, the state will be changed to Active in Good Standing by the system. Any applicable grace period starts from this point. The repayment schedule will be regenerated in case the disbursement date is changed. |

Closed - Obligations met | The system moves accounts into this state automatically when a loan amount is completely paid off. This state change cannot be manual. |

Closed - Rescheduled | Due to some reason, if the customer is unable to repay the loan on time, he or she can request for loan rescheduling. If MFI allows rescheduling, the current loan account has to be closed with the status marked as Closed- Rescheduled and a new loan account has to be created which can have the same or different conditions and rules compared to the previous loan. Mifos system does not link the old and new accounts. In performance reporting and other reporting, this loan is not counted; counter should be decremented If this loan is included in the loan cycle, it should be removed from there when the loan account status is changed to Closed- Rescheduled. |

Active- Bad standing | Due to violations and/or non-repayment etc, the customer loan account can be marked as “Active- Bad standing”. From this state, customer account can go to “Active in good standing” or “Closed - Written Off”. System will move the loan account to this state automatically, in case it exceeds the “Definition of lateness” as defined by the HO i.e., system has not received any payment for X number of days. (X is the lateness specified at the HO level.) System will move the account back to the “Active in good standing” status when the total amount overdue has been paid up, that is the complete principal overdue + interest overdue + fee overdue+ penalty overdue has been paid up. The state change from “Active in good standing” to “Active in bad standing” and vice versa will always be automatic. Manual change will not be allowed. |

Closed- Written Off | If the MFI/LO determines that the customer cannot repay or has no intentions to repay the loan, the loan has to be “Written off” and the system should make the required accounting/financial entries. Transactions cannot be applied to accounts in this status. |

Canceled | A loan application can be cancelled due to various reasons like,

|

Notes on Loan States:

- When an account is created, it can be saved in either Partial Application state or Pending Approval state. If Pending Approval (an optional state) is not included by the HO, a user with required permissions can save a new loan account in Approved state. Note that removing optional

- There is no restriction on the number of times an account state can be changed.

- When reporting on or searching All Active loans, the system includes both Active in good standing and Active in bad standing loans by default. User can filter on Active in good standing OR Active in bad standing loans separately.

- The above logic also applies to All Closed Loans, which includes Closed- Obligation met and Closed- Written Off.

- There is no Deleted status. All loan accounts are kept in the system.

Status History

Mifos automatically tracks all changes in the loan states. [where is it accessed?] The first entry in this history is the creation of the loan record and shows the change of state from New to Open. The last entry is the transition of the loan to a final state of either Closed or Canceled.

This information can be used to track performance of the LO or efficiency of the MFI’s processes by tracking duration between loan/savings statuses.

The following attributes are captured when the status is changed and saved. All these fields are generated by Mifos and are not editable.

| S. No.

| Attribute Name

| Data Type

| Description/ Notes

|

|---|---|---|---|

1. | Old Status | String |

|

2. | New Status | String |

|

3.. | Date Changed | Date | This is the system date when the status is saved into a new status. |

4. | Changed By | String | This is the username of the system user who performed the change in status. |

Loan Account Details

Once a user with the appropriate permissions has entered the data to create a loan, the user then previews the entire set of information in one screen, to validate the data. This is a mandatory step. When the user approves the preview page, the loan information is saved in the database. Error checking for mandatory fields and valid data is performed. If any invalid entry is found or any mandatory fields have been left empty, an error message is displayed.

Once a loan account has been created, its information can be viewed and edited on the account details page, as described in the following paragraphs.

It is also possible to sort loan account details and put then into order, which is the most suitable for user.

Account Summary

The account summary section of the details page gives an overview of the amount paid and due after the last transaction. This information is updated by the system according to the values defined in the loan attributes table, and is not editable by the user.

The account summary is updated when the system detects any of the following actions:

- Disbursal is done or a payment is made: amount paid and amount due are adjusted accordingly.

- Changes in fee types: addition/removal/waiving of fee types/misc fee or misc penalty, change in fee amount etc. changes the amount due. Already charged fees, including unpaid fees, cannot be changed.

The following information is updated whenever a payment is made:

- Total amount due and the date of next repayment. This total amount is the sum of the original installment and the amount in arrears.

- Amount in arrears. This is the amount from previous installment(s) not received on the scheduled date.

The following information is included in a table, which is updated whenever a payment is made. The amounts due are calculated as follows:

Original Loan | Amount Paid | Loan Balance | |

|---|---|---|---|

Principal | Original loan amount- This figure is not updated after the account has been Approved. | Amount paid against principal till date | Original loan amount paid |

Interest | Interest expected from this account This figure is not updated once the account becomes Approved. | Amount paid against interest till date. | Amount of interest remaining on the loan

|

Fees | Amount expected from this account as per the fee types attached to the account | Amount paid against fees and miscellaneous fees till date | Amount expected from this account as per the fee types attached to the account. It should include unpaid miscellaneous fee charged to the account |

Penalty | N/A | Amount paid against miscellaneous penalty till date | Any miscellaneous penalty charged, and not paid. |

Total | Total of principal and interest | Total of above 4 | Total of above 4 |

If an installment payment is missed, the amount is added to the next payment and displayed in this section.

The user can view installment details by clicking the View installment details link:

Column Name | Description |

|---|---|

Current Installment Details | |

Principal | Principal due for the current/upcoming installment |

Interest | Interest due for the current/upcoming installment |

Fees | Fee due for the current/upcoming installment as per the fee types linked to the account and miscellaneous fee charged to the account This amount can be waived. |

Penalty | Any miscellaneous penalty charged This amount can be waived. |

Total | Total of Principal, Interest, Fees, and Penalty |

Overdue amount | |

Principal | Amount overdue against principal for the missed installments |

Interest | Amount overdue against interest for the missed installments |

Fees | Amount overdue against fees for the missed installments |

Penalty | This should be a summation of all misc penalties that was charged and was included in the previous installment(s), but not paid. |

Total | Total of Principal, Interest, Fees, and Penalty |

Recent Activity

Transaction history records and displays the repayment details of the account. This is updated by the system when a transaction is made. The user is not allowed to make any modifications to the transaction history.

Transactions

When an account is first created, a Disburse loan link is displayed in the Transactions box. This can be used to record the loan disbursal. After disbursal, this link is not available, but the other transaction links can be used to apply payments, charges, adjustments, or to repay the loan.

Performance History

Mifos tracks the performance of each loan and provides the following metrics, which are displayed in the Performance history box on the loan detail page.

Administrative documents

Users can prepare and print whatever administrative documents are available, such as vouchers, payment books, disbursal receipts and payment receipts, by clicking a link under Administrative documents. [link to administrative documents]

Repayment schedule

When a user creates a loan account for a client, he first identifies the client and selects a loan product from the list of products available for the client. If Mifos has been configured to require repayment on meetings days, the system displays only those products whose frequencies are equal to or multiples of the client's meeting frequency. For example, a client with a meeting frequency of three weeks on a Monday is eligible for loan products with a frequency of 3, 6, and 9 weeks. A client whose meeting frequency is the last Monday of every two months is eligible for loan products with a frequency of 2, 4, and 6 months. In Mifos 2.2, a client can have a loan account of any repayment frequency, regardless of meeting frequency, as long as LSIM is on. See Clients can have Loans of Different Frequencies FS for more details.

On the next page, the default values for that loan product are displayed, which the user may change for the new loan account, according to the ranges indicated in parentheses next to the fields on the page. Automatic administrative fees associated with the account are displayed, and the user can apply up to three additional fees to the loan.

When the user clicks Continue, an installment schedule is displayed. It is based on the loan amount, interest rate, repayment frequency, and the number of installments specified. For more information regarding principal and interest calculations, see . The following information is displayed, which is independent of the grace period and meeting schedule the client belongs to:

| Column Name | Description |

|---|---|

Due Date | Due date |

Date paid | Date of payment- This is not a part of repayment schedule when a loan account is created |

Principal | Principal paid/due |

Interest | Interest paid/due |

Fees | Fees paid/due |

Total | Total of Principal, Interest, and Fees |

| Running balance - This is not a part of repayment schedule when a loan account is created. | |

Principal | Total principal outstanding |

Interest | Total interest outstanding |

Fees | Total fees outstanding |

Total | Total of Running balance, Principal, Interest, and Fees |

If the loan is a variable installment loan, the user is able to edit the loan schedule here. If Compare with Cash Flow is checked, the user is also able to enter in cash flow details. See Variable Loan Installments and Cash Flow Comparision FS for more information.

Notes on repayment schedule:

- The disbursement date for a loan is defined prior to the actual disbursement of the loan and is used as the reference point for creating the schedule. If an MFI has configured disbursements to occur on meeting days, then the Repayment Start Date is the frequency of loan repayment + grace period duration. The Installment Due Dates are calculated based on Previous Installment Due Date + Frequency Elapsed. If payments are allowed on non-meeting days, a user can change the default disbursal date to a non-meeting date, which must be a date in the future.

- Grace period. This repayment schedule is considered as the Original repayment schedule. Once the loan amount is disbursed to the client, the interest rate cannot be changed. The grace period starts from the day the loan is disbursed to the client and can be modified by a user for a specific loan account before the grace period ends for that account [link]. A user can edit the disbursal date or the repayment date, but it must fall within the acceptable range defined by the user. If no range is defined, there must still be at least one day separating the loan schedule start date from the disbursal date.

- Non-meeting days. If payments are not allowed on non-meeting days, then the repayment schedule is not editable by the user. [true?] However, the schedule is automatically updated by the system when there is a change in any one of the parameters displayed in the Repayment Schedule table. If the loan duration extends beyond the current year, the system creates the repayment schedule for all years. However, the system assumes that the subsequent years have no holidays. If payments are allowed on non-meeting days, then the user can change the default repayment day. However, the repayment days must still occur at the same frequency as meetings days. For example, if meetings are once a month, loan repayments must be once a month, even if they occur on different days of the month than the meetings.

- The frequency of repayment is defined by the product definition and cannot be changed for a specific loan, only the day can be changed. For example, if meetings are defined for a client as occurring every 4 Tuesday of each 1 month, on the loan account page, the user can only change the day of the repayments (Tuesday can be changed to Wednesday). It is possible to make daily, weekly and monthly repayments.

The repayment schedule can be accessed at any time by clicking the View payment schedule link on the loan account details page.

Note: Also see http://groups.google.com/group/mifosfunctional/browse_thread/thread/7ca15f34dc937d9c for more details on how repayment schedules are created.

Edit disbursal date/repayment day

On the loan account details page, the user clicks the Edit account information link and then edits the disbursal date and/or the repayment day. The system validates that the edits satisfy the predefined interval between the disbursal date and the loan schedule state date and then calculates and displays a new repayment schedule. The system also validates that the date entered is a future date and that the repayment interval has not been altered.

Bulk loan creation and approval

Mifos offers bulk processing features to facilitate creating multiple loan accounts based on the same product definition and approval multiple loans in the Pending approval state.

Bulk loan creation for centers

A user with the appropriate permissions can create loan accounts for all or some clients in a center at one time. These loan accounts will be defined by the same loan product and will be created with the same loan information, except for the loan amount and purpose.

To do this, the user clicks the Create multiple loan accounts link on the Client & Accounts Tasks navigation pane and filters the accounts by branch, loan officer, center (or group if the center hierarchy doesn't exist) and loan product. The system displays the approved clients in the groups in the user’s data scope. The user selects those clients for whom loan accounts are to be created and specifies the loan amount and purpose.

Bulk loan creation does not allow specifying all attributes of a loan including collateral type and info, custom fields and source of funds.

This feature also does not work with loan products with variable loan installments or with interest rate type of Declining Balance - Interest Recalculation

Bulk loan approval

Loans are usually approved by the branch manager. When a loan account in the Pending approval state (or Partial application state if the Pending approval state is not available) fulfills the eligibility criterion, a user with appropriate permissions can approve such loans one at a time by clicking the Edit change status link on the loan account detail page and changing the status to Approved. Alternatively, a user can filter all the loan accounts in his/her data scope that are Pending approval, and change the state to Approved at one time.

To do this, the user clicks the Change account status link on the Clients & Accounts Tasks navigation pane and filters the accounts by branch, loan officer, type, and current status.

Apply guaranty

Guarantor is a person, who will ensure that loan account will be paid. On loan details page it is possible to attach guarantor to loan account. Guarantee can be applied only to loan account and individual loan account. It is possible to display guarantor's details and remove guarantor.

Client that is an "active" guarantor has a note displayed on the guarantors client page saying that this client is guarantying a loan for client (loan id and client name is displayed).